Keynes versus Friedman forever (II)

Mariano Aldama of the Royal Bank of Scotland and responsible for capital market origination for financial institutions in Spain and Portugal, has given an interview to the business daily Cinco Días in which he admits that, despite the critical situation of Spain because of excessive financing costs, it is possible to restore market confidence. We offer an excerpt of the interview. How long can the banking system resist without financing itself? The rejection in the markets can not last much longer but first there are pieces of the puzzle that…

Berlusconi’s resignation and Mario Monti’s designation have had an unenthusiastic impact on the European stocks, Barclays notes. “A positive welcome at the beginning has been followed by a general fall of all indexes, including Milan which had increased about 25 early yesterday in the morning. The political change did not help the 5-year bond auction either, because the Italian Treasure issued €3bn at 6.29%, the highest rate since 1997. After…

Berlusconi’s resignation and Mario Monti’s designation have had an unenthusiastic impact on the European stocks, Barclays notes. “A positive welcome at the beginning has been followed by a general fall of all indexes, including Milan which had increased about 25 early yesterday in the morning. The political change did not help the 5-year bond auction either, because the Italian Treasure issued €3bn at 6.29%, the highest rate since 1997. After…

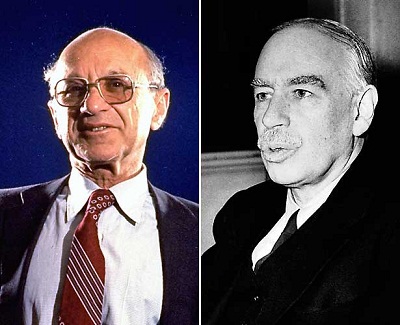

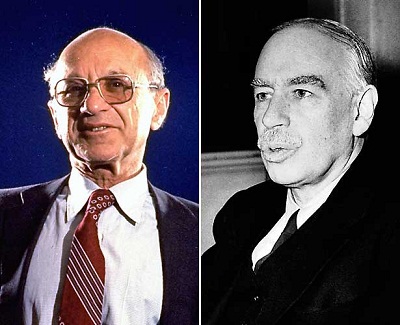

By Miguel Navascués, in Madrid | H. Clark Johnson, professor at Yale University, identifies in a paper titled Monetary policy and the Great Recession, what he calls the six myths of U.S. monetary policy during the Great Depression. The paper not only explains the cause of the hole we’re in, but also the reasons why zero interest rate does not imply monetary expansion. In the latter case, the reason is simple:…

By Miguel Navascués, in Madrid | H. Clark Johnson, professor at Yale University, identifies in a paper titled Monetary policy and the Great Recession, what he calls the six myths of U.S. monetary policy during the Great Depression. The paper not only explains the cause of the hole we’re in, but also the reasons why zero interest rate does not imply monetary expansion. In the latter case, the reason is simple:…

According to ACF, the total amount of debt purchased by the ECB has doubled since the beginning of August. “The ECB increased purchases of sovereign debt during the last week up to €13.960bn. This is comparing to the previous week’s €13.300bn. The total amount of debt purchased by the ECB has almost doubled in the last five weeks. Since the purchasing program began in May 2010 up until last August…

You’ve certainly read by now Warren Buffet’s op-ed column in The New York Times “Stopping to coddle the super-rich”. Mr Buffett talked about raising the tax rate to the “rich” and “super-rich” in an effort to reduce the huge deficit in the US. While in Europe some members of the wealthy elite –like Maurice Lévy, chairman and chief executive of the French advertising firm Publicis or multimillionaire chairman of Ferrari…