“European banks would do a lot better if they lent more to fuel consumption”

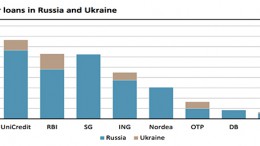

Ana María Llopis, independent director at Societe Generale explains that “the entity’s share price was at 40 euros before the crisis and now it is around 42-44 euros. So some banks have recovered. Then there are others still at low prices for particular reasons, or because they operate in China or Brazil.”