UBS | One of the main reasons for the European economy and equities lagging behind the US has been the desperately slow turn in Eurozone credit growth. Whilst hardly booming, banks’ lending to corporates in the Eurozone has just turned positive for the first time after 38 months in a row of negative numbers.

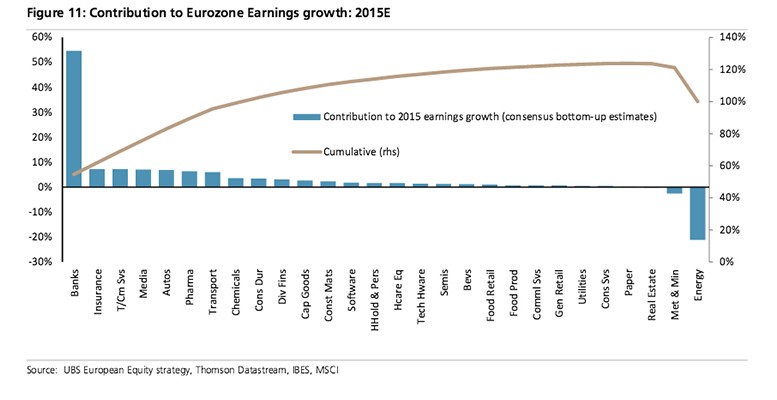

With P/E multiples close to long-run averages, earnings are now key. The banks make up around 60% of 2015E expected earnings growth for the market and c.30% for 2016E.

Additionally, the ECB bank lending survey points to easier supply of credit and, perhaps surprisingly, increased demand for credit. In the past, the current improvement in the ECB survey for demand for loans has led to higher EPS growth in the banks. The RoE in Europe is at just 11.1% -not far from the 2009/2010 lows of 10.5%. Likewise, banks make up half of the total expected boost in European RoE over the next 2 years.

If we are just witnessing the beginning of a long overdue profit recovery in Europe, the recovery in European ROEs still seems elusive. ROEs for the MSCI Europe have fallen from c17% to c11% on FY2015 numbers. We do not expect ROEs to recover to the previous peaks in part because some sectors face structural chal lenges. Even if ROEs are not set to return to the heady levels of 2007, there is still large scope for improvement from here.

It is also important to note that this expected recovery is not widespread. Across sectors ROE growth is driven in large by the Banks and Div Fins (Investment Banks). Together they contribute about half of the market’s ROE growth expected to FY2016. Although, given capital has trebled from the lows and a likely continued low interest rate environment, Bank ROEs are clearly very unlikely to get back to previous peaks in the foreseeable future.

Hence, it is crucial to see a recovery in the Banking sector for this ROE pick – up to take place. One of the key drivers of that recovery to us is a pick-up in credit demand in Europe. Recent ECB data have shown demand for loans, and in particular business loans, which have a lead relationship with Bank earnings is on the rise. This leads to an unusual situation in which the trade-off between valuation and growth for the Financials is not as we would expect.

Looking across sectors the Financials offer the strongest forward earnings growth but are trading at the cheapest valuations. This puts the sector in a strong position in our view.

The European market is trading on 14.7x 12m forward earnings, but there is a big dispersion across sectors within that. The total market (including Banks) is trading at a 7% discount on P/E and a 16% discount on P/BV to the mar ket ex – Banks. The valuation case is stronger including the Banks.