Energy Sector Carries The Highest Yields In Europe

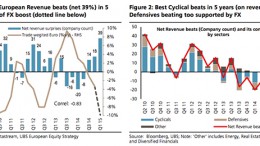

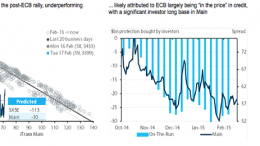

UBS | German 10yr bond yields have turned negative and some European corporates are effectively “being paid to borrow”. What are the implications for European equities? Although there has been a deepening of Global growth fears in recent weeks, economic surprise indicators and PMIs have not collapsed.