ECB seeks “full QE implementation”

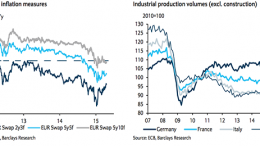

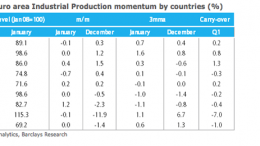

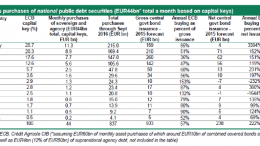

MADRID | June 3, 2015 | So far, monetary policy stimulus is working as planned, ECB’s president Mario Draghi insisted on Wednesday, and the bond buying program needs to reach full implementation until September 2016. The central lender rules out any earlier taper and will keep rates on hold.