eurozone

Bundesbank: the economy has not changed direction

BERLIN | Alberto Lozano | After the strong performance of the German stock market yesterday, one of the hardest hit in recent weeks by the greater exposure of its companies to the Russian market, Bundesbank president Jens Weidmann expressed his confidence in the growth of the German economy and the euro area during the second half of the year after the paralysis of the second quarter. In fact, Bundesbank considers that the “accumulation of bad news” is responsible of the decline in the 2Q, what could change the spring forecasts, although the basic trend suggests a strengthening in the second half of the year. Moreover, the Bundesbank wanted to make clear that although “the sentiment has deteriorated from a high level, the fact that the trend for domestic demand continues basically high suggests the economy has not changed direction.”

Markets welcome Eurozone economic ‘bad news’

MADRID | By J. J. Fdez-Figares (LINK) | Stock markets face today a new week in which geopolitical conflicts, especially in Ukraine, and macroeconomic data that will be announced during the day will monopolize the attention of investors. Although we expect trading volumes remain low, typical of summer dates, we do expect a slight rise in volatility, especially given the current stage of confusion, both in the geopolitical and economic environment that financial markets are facing.

ECB under pressure, markets demand QE policy

MADRID | The Corner | The European weak economic growth increases the pressure on the ECB to take additional measures or the long-awaited QE to boost growth, beyond those already announced in June and of which the effects probably will not be seen until 2015. At the moment the ECB in its monthly report reemphasized that there is “a continued moderate and uneven recovery of the euro area economy”, with low inflation rates and a weak monetary and credit evolution. At the same time, inflation expectations for the euro area in the medium and long term remain firmly anchored in line with the ECB’s target of keeping the inflation rates at levels below but close to 2%.

Spain’s growth beats its EZ larger peers in the 2Q

MADRID | The Corner | Spain’s GDP expanded by 0.6% in the 2Q of 2014 over the previous quarter, the fastest pace in the Eurozone after Latvia’s growth (+1%). With Portugal (+0.6%) and Netherlands (+0.5%), Spain becomes one of the best economic performers in the eurozone during this quarter. Moreover, according to the figures published today by Eurostat, the Euro area has stalled in the 2Q, especially as a result of the contraction of Germany, the Italian fall into recession and France’s stagnation. Meanwhile, the Greek economy contracted by 0.2%, the lowest drop since 3Q 2008 and it could show that the country is meeting its full year growth target of 0.6% for 2014.

Euro falls against dollar after Ukraine, Draghi and EZ poor data

MADRID | The Corner | The positive evolution of the American economy and the uncertainty about Europe’s economic recovery, after disappointing data published this week, have led the USD to Euro exchange rate to advance to its highest best level in nine months.

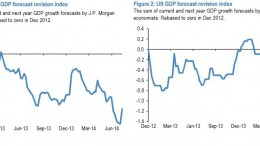

JPMorgan: Global economy might pivot to above trend growth in 3Q

MADRID | The Corner | JPMorgan’s economic outlook forecasts that global growth is taking hold around midyear and as a rebound from weakness the US and Japan is reinforcing a more modest acceleration in the Euro area and emerging Asia. If JPMorgan analysts are right, this episode’s contours should mirror growth pivots in earlier expansions (during 2003 and 1993).

ECB press conference: Draghi to analyze markets and political instability

Berlin | By Alberto Lozano | Mario Draghi is speaking today again. Although no decisions or changes in the ECB’s monetary policy are expected, markets expect to know the ECB president’s assessment of the latest economic and financial developments.

EZ: Inflation and unemployment rate falls slightly in July

MADRID | The Corner | The fall in inflation in July to 0,4% YoY and a still high unemployment rate of 11.5% in the Eurozone show that the policy measures the ECB announced in June are going to take some time to reach the real economy.

BCE: Widespread decline in interest rates of banking corporate credit

MADRID | The Corner | The ECB reported on Thursday the data of interest rates applied in banking corporate loans in June, which have been reduced by 18 bp in loans worth up to €1M for the EZ (up to 3.57%). Moreover, these discounts have been widespread and even higher in peripheral economies’ banks: -21 bp up to 4.3% (weighting by GDP of rates applied in Spain, Italy, Ireland and Portugal).