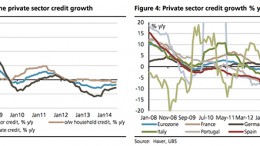

TLTRO alone might not be a game changer for Eurozone credit recovery

MADRID | The Corner | Supply and demand conditions for Eurozone credit generation are improving – this is clearly reflected in the ECB’s latest Bank Lending Survey – but the way towards a full normalisation is still long. We believe that reduced bank funding costs might support, but will not aggressively accelerate, the recovery in credit growth.