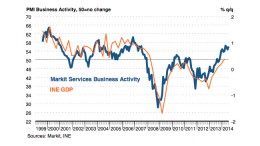

Spanish PMI rebounds

The Corner | April 7, 2015 | Analysis from Barclays | Spanish composite PMIs rebounded to 56.9 (+0.9 point) in March, as services PMI overshot expectations (57.3) and manufacturing output remained broadly stable (55.5). The services sector’s solid performance (PMI at an eight month high) was primarily triggered by stronger new business.