Alphavalue | In order to fight against what is now sadly known as the Wuhan coronavirus, China is using the major weapons a dictatorship “offers”: restriction of movement on the population. In other words, individuals’ freedom of travel is limited in favour of the nation and, most likely, the rest of the planet as well. And the western world can be thankful.

In macroeconomic terms, this can quickly be translated into a slowdown in GDP, assuming that containing the problem is a six-month process. If China focuses its efforts on controlling the spread of the coronavirus, it is likely the rest of the planet will miss the country’s production capacity.

Therefore fears about the financial system’s capacity to recover will multiply. It is easy for the People’s Bank of China (PBoC) to open the credit tap. However it is not so clear how the weak life insurance sector could be affected by the rapid rise in mortality and the consequent dumping of financial assets to deal with the commitments.

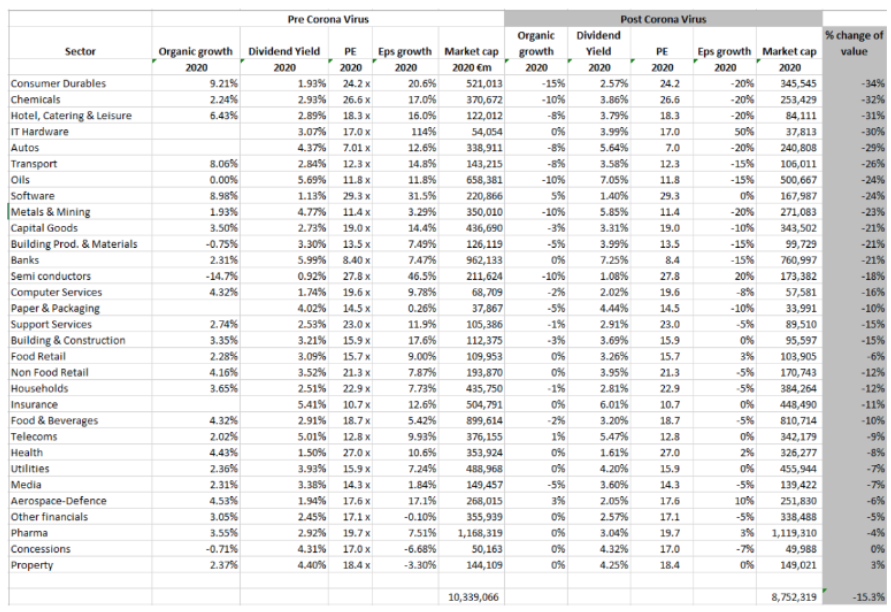

The table below (“quick & dirty guide”) offers a version of perceptions about the downward revisions to our estimates for top-line and BPA growth for each sector by 2020.The objective is to provide a response to what could possibly be a very negative impact on the Stoxx600.

The table would need to be updated as fast as the number of cases of people affected by the coronavirus spreads, and not so much for economic reasons. Everything would depend on the multiplier factor of the contagion to healthy people from infected people.

The magnitude of the downward revisions to the sectors should not come as a big surprise. In a very negative case (“worst case scenario”), the luxury sector could lose 34% and may come as an unpleasant surprise. The Stoxx600 would drop by 15% if fundamentals are threatened again. Although they were not a problem 10 days ago, it seems that sensitivity has increased now.

The reality is likely to be different, given that we have learned a lot about the central banks’s capability to reduce tensions in the markets.