In other words lags in the implementation of monetary policy are not “long and variable” lags, but “infinitely short and not variable”. This time it was from the ECB.

The ECB is operating a far from perfect monetary policy. It has to do huge QE to (nominally) stimulate the EuroZone economy since it is has massively handicapped both itself and the economy by its inflation target of “near but no more than” 2%. Of course, it should move to a strict NGDP Growth Level Target of 5%, but moving will not come soon.

Just floating the idea would help more than a a several tens of billions of Euro bond purchases. Just try it!

That said, the ECB is still biased towards easing. But events elsewhere are lowering the Wicksellian Equilibrium Rate of Interest, aka getting worse. The main trouble maker is the Federal Reserve with it’s tightening bias, as well as the UK’s BoE and the Swiss National Bank, three of the major EZ trading partners. The Fed’s bias also hurts China since that emerging superpower has cravenly opted to remain within the Dollar Bloc. So China is having its monetary policy tightened while also being in a rapid economic slowdown.

Not great at all, for China or the EZ or the rest of the world.

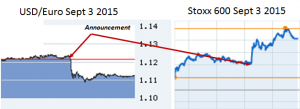

In the face of all this bad news EZ stocks have sold off with the rest of the world and the currency has been reasonably robust for the last six months. These market trends indicate deteriorating economic prospects for the EZ. Today, like a good central bank, the ECB stepped up to the plate to counter these negative trends.

It altered the rules for the current QE programme in a surprisingly positive way. The market responded immediately at exactly the time of the announcement, driving up stocks and driving down the Euro vs the USD.

A good thing, and demonstrating the impact of monetary policy on forecasts for the real economy, and thus the real economy itself.

Actual Fed tightening and Chinese masochistic obstinacy may well swamp these effects over the next few months but the ECB has today shown a good determination to ring-fence the EZ from poor monetary policy elsewhere in the world.