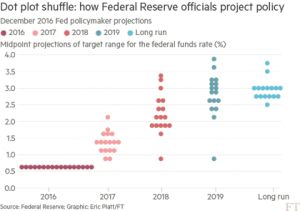

The Fed has increased its daily interest rate to 0.75%, saying it predicts three further hikes in 2017. This is called active and persuasive monetary policy. But, as can be seen in the graphic below, which represents what the FOMC members think, they are not unanimous when they make their individual forecasts.

Some of them see one increase in 2017, others are allowing for three hikes of 0.5 percentage points, while there is one who augurs four 0.5 percentage points rises. The difference increases as the horizon widens. But all this is no more than wishful thinking. The persuasion is ambiguous, vague, not to mention laughable.

The forecasts imply various rate curves: the lowest predicts a margin between the interest rate today and in two years of half a percentage point difference. The highest, a minimum of 0.75% and a máximum of 3.75% in two years. You could say that this is the optimistic one, because it implies a normalisation in rates thanks to a certain normalisation in the economy, which would be growing at a nominal rate of 3%. But it’s not very optimistic to think about nominal growth (real plus inflation) of 3%. The official interest rate forecast is that by end-2017, after three 0.5 percentage points hikes, it would be at 2.25% (0.75% currently plus 1.5%).

But the central banks are no longer the masters of the economy, whipping it into a place they want. The situation we now have is that the central banks move the markets, without passing through the real economy…but recently the rate curve, represented by the differential between 10 and 2 years, does seem to fit well with the latest stock market rise which, in fact, is a record.

It’s a good omen that the 2 to 10 year spread or differential is recovering and coinciding with the stock market’s rise. But this increase is excessive, which is more risky. As we all know, every dog has its day.