In the IMF’s blog there is a brief view of how well the year has gone and the promises for the future which we can extract from this good performance. It’s worth it because of its clarity:

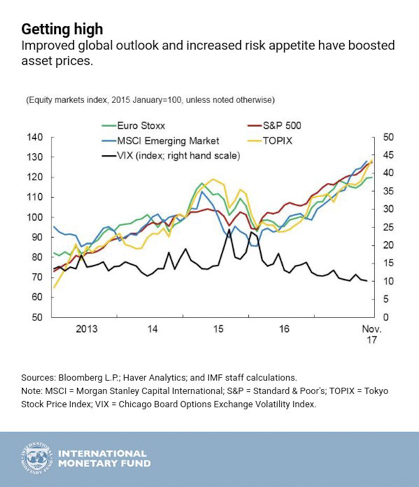

For the IMF this is proof of a general improvement which has increased the appetite for risk and buying risk assets. For me, as you know, it’s proof of an excess confidence which in the past was a trap into which the markets systematically fell. But the IMF has to accept the rationalistic view that the markets don’t get it wrong, while I maintain they quite often make mistakes. I keep saying that the ever increasing gap between the level of the stock markets and the volatility indicator doesn’t inspire with me with any confidence, on the contrary: for me its shows overwhelmingly optimistic expectations which are completely lacking in any foundation.

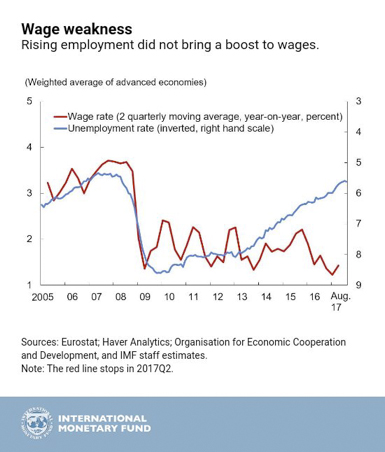

I also want to comment on another IMF graphic.

Here we see that, despite the continuing decline in unemployment (the unemployment rate is inverted, so a rise in the blue line corresponds to a drop in unemployment) wages are stagnating. In other words, the distribution of income has worsened, favouring those who have more to the detriment of those have less. So we have shareholders who are making millions and workers who, either because of international competition and other reasons, are not able to recuperate the income they have lost despite how well things are going. Sooner or later, there’s a clear conflict here. The owners of these companies have made more money while the workers have increasingly less capacity for negotiation.

In another graphic you can see that despite the rise in income, income per head in the emerging countries has fallen. It’s not that I’m a communist, but I am concerned that a society where the market is no longer distributing income in a “reasonable” way becomes hugely unstable. We will have to face this problem sooner or later and, I repeat, I am not in favour of the state distributing or rectifiying wages. I am in favour of the “old world”, where more or less when unemployment dropped, salaries increased. The Phillips curve has disappeared. There is no longer goods and services’ inflation. Central banks are puzzled. They are increasing rates because they don’t know what else to do, but if they burst the bubble, or bubbles (stock markets and property assets again in various countries) which are being formed, they will have no resources to do anything about it. Add to this mix the murky state of the banking sector in many countries, judging by the words of Aristóbulo de Juan in the Commission of the Congress. I don’t see any reasons for optimism, but hopefully I am wrong.