Caixabank | Spanish banks are strongly focused on the retail segment, which provides a more stable source of funding in the long-term. Stable deposits and operational deposits (those that have proven to be harder to withdraw) account for over 60% of total deposits for nearly all Spanish banks. This has contributed both to a positive evolution of profitability in a context of rising interest rates, as well as to a favorable liquidity position and to the stability and diversification of their funding sources.

■ Household and non-financial corporation (NFCs) deposits peaked in August 2022. March ’23 data show a modest 2,1% decline since then, but a large part is due to the repayment of COVID-related precautionary loans and increased early-repayments in mortgages. Loan-to-deposit ratio remains stable at very comfortable levels (close to 90%).

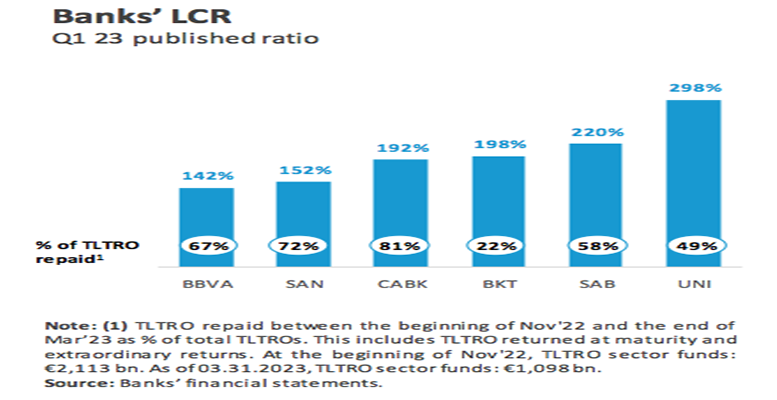

■ The Spanish banking sector maintains high liquidity ratios, far above the regulatory requirements. EBA data for 4Q22 points to an LCR ratio of 171% and an NSFR of 130% for Spanish banks (versus an EU average of 165% and 126%, respectively).

■ Spanish banks have started to partially return TLTROs. Until the end of March ’23, the six leading banks had repaid on average 50% of TLTROs outstanding as of Nov ’22. Full repayment of TLTROs may have uneven impacts on banks’ LCR.