Renta 4 | Técnicas Reunidas (TRE) will publish its 2Q25 results on 31 July before the market opens (results conference call – 11:00 CET), in which we expect to see a continued gradual improvement in margins, paving the way to meet the 2025 guidance of an EBIT margin of around 4.5%. Additionally, we do not rule out that following the company’s announcement that some customers had requested an acceleration in contract execution, we may see higher-than-expected revenue growth.

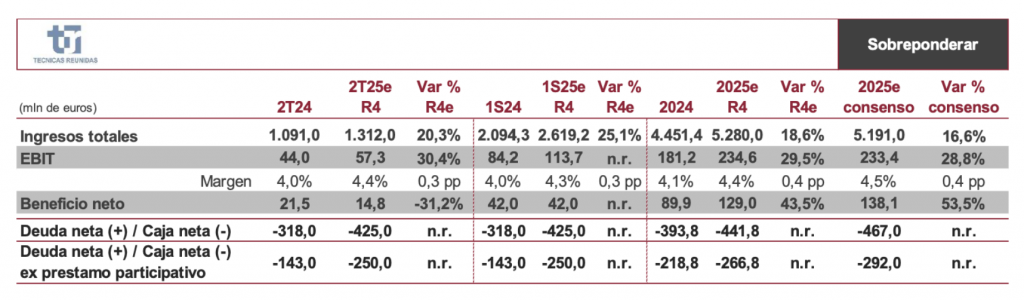

Key figures: 1) Sales of €1,312 million (up 20.3% on Q2 2024; H1 2025 estimated €2,619 million up 25.1%), confirming the acceleration in activity announced by the company given the execution of the high order book. We do not rule out positive surprises in this regard, supported by requests from certain customers to accelerate project execution. 2) EBIT margin of 4.4% in Q2 2025 against 4.0% in Q2 2024 and 4.3% in Q1 2025, confirming the margin improvement announced by the company. For the year to date, the margin stands at 4.3%. 3) Stable net cash position: we expect net cash of €425 million (€250 million if we exclude the €175 million participatory loan from SEPI) versus €423 million in Q1 2025 (€248 million without the participatory loan). 4) Order book falling to €12.5 billion/€13 billion vs. €14.928 billion in Q1 2025, reflecting the lack of new orders in the quarter and the impact of the depreciation of the dollar on a portfolio that is mainly denominated in dollars.

Keep an eye on: 1) 2025 guidance: as we mentioned earlier, we do not rule out a further improvement in revenue from the current level of over €5.2 billion and maintenance of the EBIT margin guidance at around 4.5%. 2) Order visibility: given the commercial success of 1H25, we expect 2025 to exceed our estimates of €5 billion. We would like to hear more details about the order outlook in the services division, the main catalyst for margin improvement. 3) Resolution of contractual disputes in Algeria and the United Kingdom, which could represent a significant cash inflow. 4) Update on the target for repayment of the €175 million participating loan with SEPI. 5) Confirmation of the acceleration of certain contracts.

Conclusion: good results expected, with the possibility of positive surprises, which should be reflected positively in the share price, if possible. Overweight (target price of £26.1 per share).

KEY FIGURES