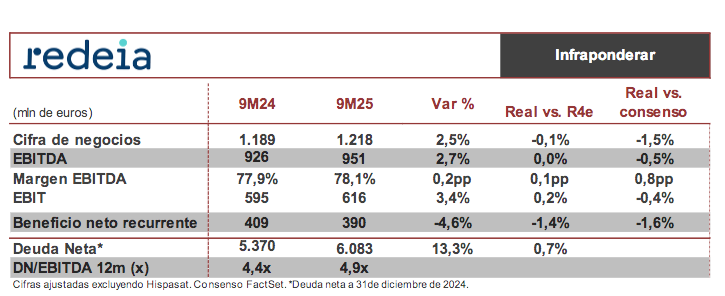

Renta 4 | Revenue is slightly up in line with our forecast due to higher revenue from transport activity due to the application of the TRF published in the draft and new commissioning, which are partially offset by lower unit values and the amortisation of RAB, as well as good performance in Peru and Chile offset by the exchange rate in Brazil, while turnover continues to decline in Reintel due to the impact of contract renegotiation. The containment of operating expenses allows for similar growth in EBITDA, and despite higher amortisation due to increased assets in operation, higher than EBIT. The decline in net profit growth is mainly due to the worse financial result from higher expenses due to the higher average balance despite a lower average cost (2.22% versus 2.25%) and lower financial income, as well as a higher tax rate and the contribution of the satellite business to the result in 9M24.

As expected, investments are accelerating, mainly for the development of the electricity transmission network in Spain. In addition, we see lower operating cash flow than in 9M24 due to last year’s collection of the amount to be refunded from the 2022 income tax on the capital gain from the sale of Reintel. Excluding this effect, FFO would have fallen by 2.9%. A refund of €400 million corresponding to the refund of tariffs from previous years is pending in the coming months. All these effects lead to net debt growing by around 13%, in line with our forecast.

The results of the investigation being carried out into the system as a result of the blackout on 28 April are pending in the coming months, and we cannot rule out that they could have some kind of direct consequence on the company depending on the outcome. We reiterate our underweight recommendation, with a target price of €18.40.