UK’s Five For Sixteen

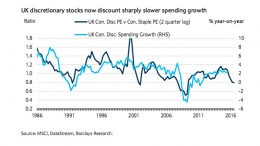

BARCLAYS | Heading into 2016, aside from the current market weakness, UK equity investors face at least five important questions. One of them is if the UK consumer is retrenching. The answer points that discretionary stocks have de-rated, while the Staples have not.