In Europe

ECB next stress test to affect just 50-60 banks

The European Central Bank will examine the European banking sector again in 2016. The stress test will maintain the same structure as in 2014, but the Asset Quality Review will not be carried out this time round.

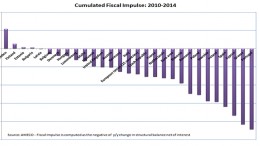

And the Winner is (should be)…. Fiscal Policy!

PARIS | By Francesco Saraceno | So, Mario Draghi is disappointed by eurozone growth, and is ready to step up the ECB quantitative easing program. The monetary expansion apparently is not working out as planned.

Greek QE eligibility? We’re not there yet

By Manos Giakoumis at MacroPolis | Following the European Central Bank’s governing council meeting on Thursday, Mario Draghi provided more detail about issues relating to the eligibility of Greek government bonds (GGBs) for the Quantitative Easing (QE) programme and reinstating the waiver on Greek government securities for ECB funding.

Austerity Economics is Fraying Europe’s Social Contract

Conn M. Hallinan | On one level, the recent financial agreement between the European Union (EU) and Greece makes no sense. Not a single major economist thinks the $96 billion loan will allow Athens to repay its debts or get the economy moving anywhere but downward.

Tsipras and the binary opposition

ATHENS | By Nick Malkoutzis via Macropolis | Greek mainstream parties and media will not have Greeks’ trust for next elections.

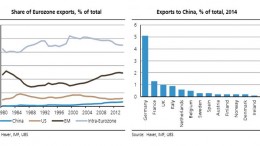

China risks for Europe: What is priced in?

LONDON | UBS | How would China’s fallout affect Europe’s economic growth?

Improvement in German domestic demand could offset China jitters

The German economy continues sound but turbulence coming from emerging markets could impact sharply on Germany’s export-led growth.

Key risks for Europe: Greece, China and Fed

New risks and setbacks again threaten Europe’s economic sentiment.

Germany approves Greece’s bailout: a reflection

What is the meaning of all this dynamic of successive bankruptcies and bailouts?