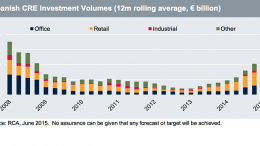

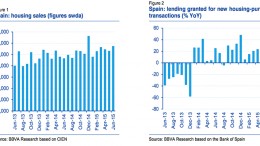

Spain real estate investment moving towards pre-crisis levels

Deutsche AWM | Capital is moving beyond Madrid and Barcelona. Yields continue to fall and are now close to historical lows. Positive yield impact is to have run its course mostly by end-2016.