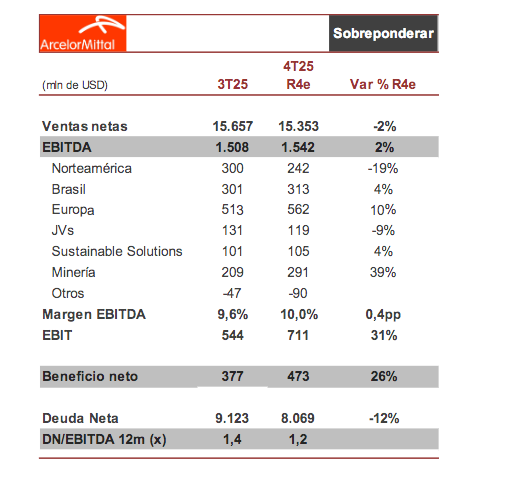

Renta 4 | The company will publish its Q4 2025 results on Thursday, 5 February, before the market opens, and will hold a conference at 3:30 p.m. P.O. We expect shipments to increase by 1% compared to Q3 2025 (North America down 1% , Brazil up 2% and Europe down 4%) and prices to fall by 6% compared to Q3 2025 (North America down 13%, Brazil down 2% and Europe down 2%). North America continues to be affected by tariffs (Mexico and Canada), which are partially offset by Calvert’s entry starting in Q3 2025. In addition, volumes will be affected by typical year-end seasonality (about two weeks less production). Meanwhile, in Europe, the market continues to be heavily penalised by imports. We expect the JVs, now without Calvert’s contribution from Q3 2025, to contribute $119 million to EBITDA (compared to $131 million in Q3 2025) due to weaker demand in India, and for Sustainable Solutions’ contribution to remain stable at $105 million ($101 million in Q3 25). Strong growth in Mining, mainly due to the entry of capacity in Liberia. We expect an increase in shipments of 1.5 Mt compared to Q3 25 to 9.7 Mt and prices (up 5%), which should have an impact on revenue and EBITDA, up 33% and 39% compared to Q3 25, respectively. Thus, we expect group revenue to decline by 2% to $15.353 billion, EBITDA to increase by 2% compared to Q3 25 to $1.542 billion, and net income to be $473 million (vs. $377 million in Q3 25).

➢ We estimate that net debt will decrease by approximately $1.1 billion compared to Q3 25 to $8.069 billion, mainly due to the typical year-end recovery in cash flow (Renta 4 estimate: $1.908 billion).

In addition, we discount capex of $1.71 billion, to close 2025 at $4.8 billion, in the middle of the expected range, $209 million in dividends and only $32 million in share buybacks.

The 2025 Renta 4 estimate net debt/EBITDA multiple would be 1.2x, a very conservative level.

➢ At the conference (5 February at 3:30 p.m.), we believe the main issue will be the approval of regulatory changes on imports in Europe, but also in India and Brazil.

In addition, we will be watching for: 1) the tone of demand (apparent and final), which could begin to improve in anticipation of the entry into force of the new tariff policy in a scenario of relatively low inventories, and 2) the possible announcement of a new share buyback plan, despite the sharp rebound in the shares.

P.O. Under review (previously €39.0) and OVERWEIGHT recommendation.