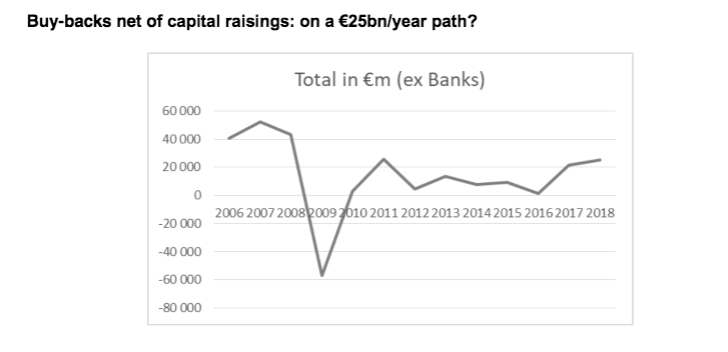

European buybacks seem to be increasing by approximately 25 billion euros to a universe of 420 shares (excluding the banks) with a combined market capitalisation of 8 billion euros. The figures which follow, given by Alphavalue, are net of capital hikes and they reach, in the banking sector alone, nearly 500 billion euros between 2006-2017. The analysts explain:

For reasons of clarity, the banks have been excluded from the following table, but it’s obvious that buybacks in the last 11 years are a very small proportion of what investors have been asked for.

From another perspective, the proportion of earnings distributed amongst shareholders (pay-out), excluding the banks in 2018, should be approximately 255 billion euros (10 times more than the buybacks), while free cash flow (FCF) should be around 385 billion. In theory, 73% of the pay-out capacity of 385 billion euros is used (dividends + buybacks). In 2007 (before the financial crisis), the pay-out capacity was 274 billion euros, of which 85% was used. Assuming this historic moment is a point of reference, investors in European stocks can hope for a further 46 billion euros in additional dividends or buybacks.

Remember that this excludes the banks, which should pay out 52 billion euros in dividends in 2018. The sectors which contribute most to the buybacks are the pharmaceuticals (65 billion euros in 12 years), oil companies (56 billion euros), food and beverages (48 billion euros) and telecos (23 billion euros).

Oil companies and telecos are the surprises here, given that they had some bad times during the period. With respect to their respective market capitalisations, both sectors exceed pharmas and food and beverages. The pharmas have a lot of cash and are increasing their shareholder remuneration, either through dividends or share buybacks. Their capacity for reconstructing the excess capital is definitely surprising.

By the same token, the capacity of the big oil companies to go from burning cash to having available cash flows for buybacks in 2018 is impressive. What the future brings will obviously depend on the duration and the depth of the economic recovery in Europe and the return on corporate shares linked to FCF. But let’s not forget the tax arbitrage introduced by the new fiscal legislation in the US. The implications are very difficult to evaluate in terms of the impact on the cost of capital and, as a result, how companies will view the dividend/buyback balance in the future. In the short-term, the oil companies are a reasonably safe bet for investors focusing on buybacks.

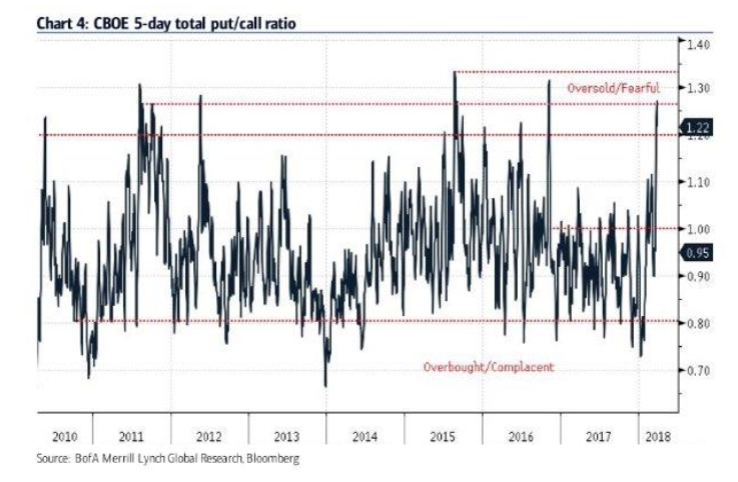

The put/call ratio has been at record highs since 2016, which is usually a bullish sign for the stock markets.

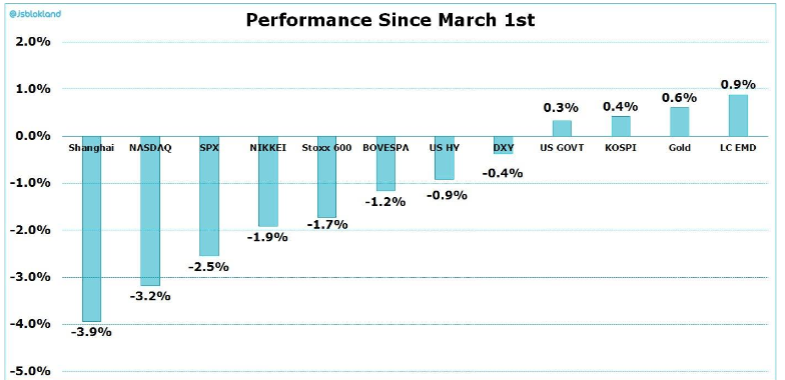

This has been the trend in the main markets since Donald Trump announced tariffs on steel and aluminium imports on March 1.

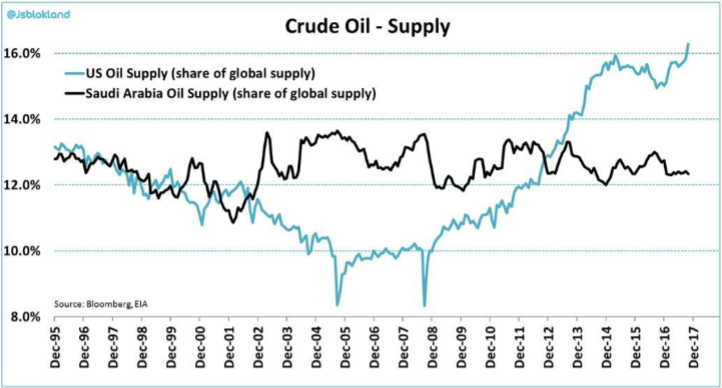

In this other graphic, you can see the supply of oil coming from the US, which is already much bigger than that of Saudi Arabia. This is a factor which will limit any rise in oil prices.