Intermoney | The company (Buy, PO €1.0) published its results for the first nine months yesterday after the market closed.

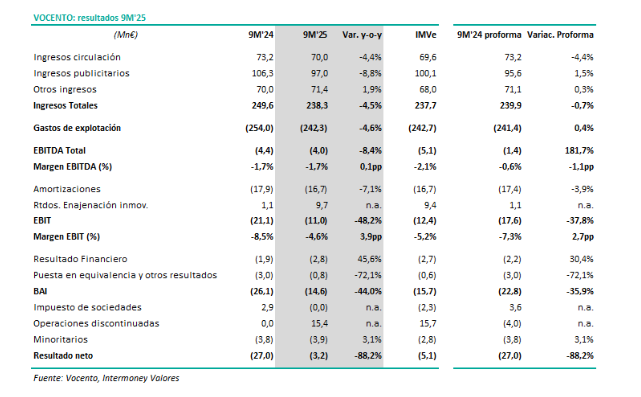

The performance is greatly affected by changes in the scope of consolidation (the cessation of the Digital Services and Relevo sports newspaper activities, as well as the sale of pisos.com, businesses that in 9M24 contributed €9.7 million in revenue and EBITDA losses of €2.9 million).

In comparable terms, revenue fell slightly (down 0.7% to €238.3 million, very much in line with our estimate) and EBITDA was negative at -€4.0 million ( against our estimate of -€5.1 million).

The decline in revenue is due to lower circulation revenue (down 4.4% in 9M and 5.0% in Q3), as advertising revenue performed well (up 1.5% thanks to 5.3% growth in Q3’25) and other revenue also performed well (up 0.3% in 9M and 3.8% in Q3).

EBITDA was significantly affected by restructuring costs (€9.1 million in 9M25 and €7.05 million in 9M24); without these costs, EBITDA would have been positive at €5.1 million ( compared to €5.6 million in 9M24).

We note that the company’s target is to achieve EBITDA of €26-28 million in 2025, excluding restructuring costs.

Net profit was down €3.2 million (exceeding our forecast of €5.1 million), with a sharp reduction in losses compared to €27.0 million in 9M24 thanks to capital gains from the sale of real estate (€9.7 million net of taxes) and the sale of pisos.com (€18 million capital gain reduced by Relevo’s negative result).

Despite the payment of €13.0 million in compensation, the sale of assets (with a cash inflow of €40.4 million) has enabled debt to be reduced by 32% to €29.4 million (ex-IFRS 16).