Corporate bond markets have continued to take advantage of the relative improvement in expectations dominating the world’s financial markets. As in the previous month, in October private debt activity was characterized by two aspects. The first, the fall in spreads of the main indices. The second, the continuing large volumes of emissions and purchases.

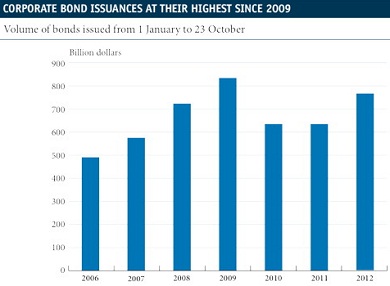

In the first nine months of the year, the global volume of corporate bonds issued was 6% higher than the figure for the same period a year ago. In the United States, improved monetary conditions related to the Fed’s QE as well as the recovery in sustainable growth prospects have pushed private investors to look for assets with a more aggressive yield and risk profile, such as high yield bonds. Many firms, taking advantage of this renewed appetite for risk, have intensified the rate they issue debt and at very low financing costs, in some sector even surpassing the financing requirements and therefore accumulating liquidity.

However, the most significant news comes from the euro area. Europe’s primary market continues to benefit from the window of opportunity opened up by the European Central Bank after its meeting on 6 September.

On that occasion, in addition to committing itself to providing financial support to economies in difficulty, the institution also relaxed rules on the collateral banks can discount at the ECB. In fact, given the improved expectations of success for the euro area’s monetary and fiscal union, companies have resorted to these markets in search for financing under affordable conditions. During October, this trend consolidated, of note being the rise in emissions by companies from peripheral countries and their good acceptance by international investors.

In this section we must also mention the revision carried out by Standard & Poor’s and Moody’s of the credit rating for Spain’s financial system. Both agencies, after announcing that they were leaving Spain’s sovereign debt rating one notch above «junk bonds», have lowered the rating of several banks but not as much as had been feared. In their opinion, Spain’s three main banks deserve an investment grade rating, something that provides significant support for the senior debt spread in the short and medium term.

Be the first to comment on "Corporate bonds gain positions"