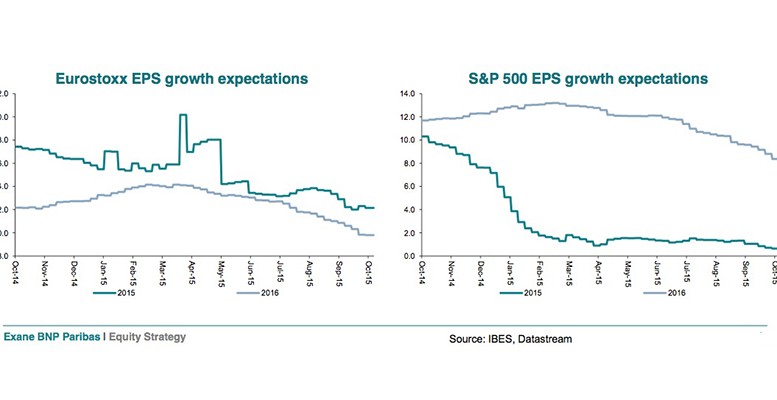

After the damp squib of the Chinese plenary session, the ongoing weakness in manufacturing surveys offers little comfort. This week’s focus likely to be the US, where a 50% market expectation of a December rate hike sits a little uncomfortably with multiple softening indicators. European PMIs and monetary outlook remain relatively favourable, while 2016 EPS growth expectations now sub-10% in US and Europe. Despite increased US tightening expectations low rate winners remains a powerful market theme.

Europe’s recovery remains far more tangible as structural reforms also look to have a higher chance of near/mid-term effect. Furthermore, Europe still 500bp below pre-crisis ROE and consequently it remains our favoured regional play.