Decisions, decisions. Has Brussels taken the right ones? On Wednesday, Morningstar Europe said capital flows made a sizeable comeback to the southern euro zone sovereign debt market in October, while JP Morgan reported that in its base scenario Spain’s government bonds will retain investment grade next year.

The European Commission has relaxed budget deficit targets for peripheral euro states, promised further support to Portugal in case of need, renounced to preferential status when the outright market transaction programme of the European Central bank begins, and agreed to softer conditionality on Greece’s financial troubles.

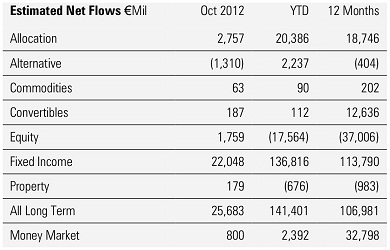

Most observers’ complaints–about banking and fiscal union–have not been met yet, but the European Union took hopeful steps during the second half of the year, analysts concluded. That October saw €22.05 billion inflow for bond funds helped to confirm the latest bout of optimism.

Morningstar’s Javier Sáenz de Cenzano spells a caveat, though: “European investors’ stampede into bond funds seems to signal a return to a less risk averse behaviour, although cautiousness still is very much present on equity markets. Yet, desperation could be the important factor here. Institutional investors are struggling to fulfil their commitments over profitability in future payments, due to the low yields of the more trusted sovereign paper. The hunt for higher risk, and higher results, in fixed income products has some potential ahead.”

Experts at JP Morgan explained that “the vision is moderately better now for peripheral bonds thanks to the ECB plans of support and some improvement in macroeconomic data.”

The investment bank expects GDP for the euro area will remain flat at 0 percent in 2013 from -0.4 percent this year, and a 1.7 percent inflation. Spain should be asking for ECB help by the April 2013, so yields on short-term credit could fall down to 2.25 percent to even 1.75 percent. Greece would hold on to its euro membership, and Italy would avoid a rescue–there’s no crash of prices in the real estate sector or deficit excess–although its public debt of 128 percent of GDP will spark uncertainty after elections.

JP Morgan also mentions France among the most acute worries. “Its fundamentals are the worst in core euro countries,” the note highlights, “and there is a big probability that the government does not meet deficit targets and additional austerity measures must be introduced in 2013.” France’s debt per GDP next year will reach 93 percent.

Be the first to comment on "European investors run into peripheral bonds for their money"