BARCLAYS | Global equities are closing in on their worst quarter since 2011, with a number of factors fuelling fears in an already jittery market.

The key to the outlook for global equities is earnings, with global valuations in line with historic averages, a supportive monetary policy backdrop, and very bearish sentiment, a major hit to EPS is the main risk for the market.

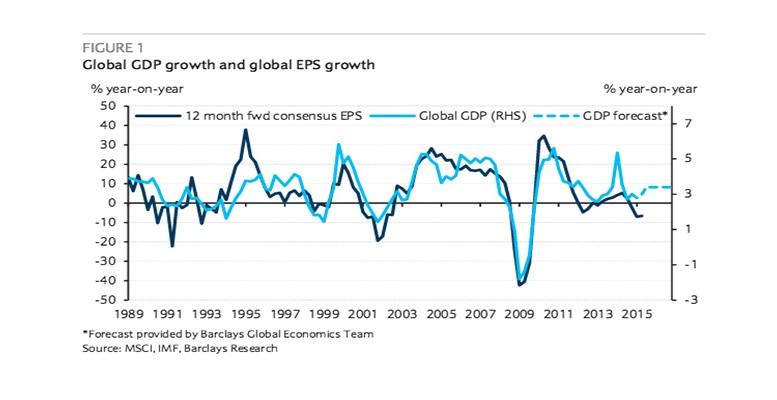

The economy and earnings Barclays’ global economics team forecasts 3. 2% global growth in the second half of 2015 and then 3.4% for 2016. This is an acceleration from the 2.9% rate in H1 2015 and compares to an average growth rate of 3.3% since 1989. Thus, although the recovery is anaemic by the standards of past cyclical upswings, it is in line with historical average growth rates, and crucially above the 2.6% threshold level for EPS growth. With this global GDP expected, global EPS should grow: we forecast 8.4% in 2016.

The other uncertainty relates to oil. Although the key variable driving the earnings outlook is indeed the growth in overall GDP, one sectoral question remains:what has happened to the oil dividend? The overall amount of global GDP spent on oil: since 2011/12 this percentage has declined from 5% to 2%: a transfer of roughly $2trn from oil producers to oil consumers.

Switching to the stock market, it is clear that analysts have been quick to cut the earnings forecasts for oil producers. Bottom-up analysts’ estimates for oil producers’ earnings have fallen by a massive $148bn since July 2014, subtracting 6pp from overall global earnings. Yet, on the other side, forecasts for sectors likely to benefit from lower oil prices have risen by just $9bn over the same period.

History suggests that, if our earnings projections are right, today’s extremely negative sentiment towards equities should unwind, with global equities able to recover the bulk of their recent losses over time.

Within the market we remain underweight in US equities, with our biggest recommended overweight position in Europe ex-UK. We also overweight both Japanese and EM equities.