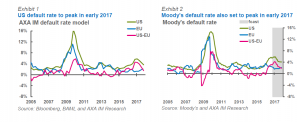

AXA IM | The easing of lending standards in the US and the rally in spreads have softened both factors that feed as inputs to our default rate model. The Fed Loan Officer survey has dropped to near flat (1.5% net tightening), after reaching a post financial crisis peak in April (11.6%). At the same time, the remarkable rally in energy and recourse sectors’ spreads has returned the distress ratio (share of bonds trading wider than 1000bps) to late 2014 levels, after reaching a 30%+ peak in February. In Europe, the improvement in the distress ratio has been less dramatic (equally, its February peak was less dramatic) while the ECB lending survey has drifted into tightening territory again for the first time since late 2013.

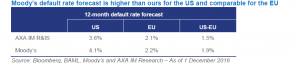

These changes in our model inputs give rise to a default rate forecast that is less hawkish for the US and less dovish for Europe than our previous expectations. We are now more bullish than Moody’s for US HY (AXA IM 3.6% vs Moody’s 4.1%) and comparable for European HY (AXA IM 2.1% vs Moody’s 2.2%). This is in contrast to a year ago when our model was more bearish for the US than Moody’s and materially more dovish for Europe, a difference which did indeed materialise.

One area where we agree with Moody’s is that January-February 2017 should see the US default rate peak at just under 6% and the US-EU default rate differential peak at just over 4% (Exhibits 1 and 2). We do, however, predict a more material narrowing in the US-EU default rate differential by this time next year, to 1.5% vs Moody’s ~2% (also shown in table above).