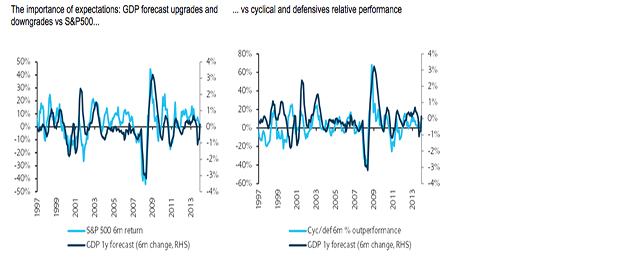

However, what was striking was the importance of economic expectations, with S&P500 returns moving in line with upgrades and downgrades in the US growth outlook (Figure 1, above left). Figure 2 (above right) plots the six-month change in the one year-ahead US GDP forecast against the relative performance of cyclical and defensive equities and reveals a similarly close relationship. It indicates that a 1% upgrade in the growth outlook leads to a 7% outperformance by cyclicals relative to defensives.

Testing the potential effect of rate hikes

We recently presented a flexible framework for analysing the cross-asset effect of various tail risk scenarios (Testing the central banks). We use a regression model that allows us to input one or two “shocks” to the market and then examine the cross-asset implications. One issue with this analysis is that there is no real precedent for the next hiking cycle, given that this time policy normalisation follows an extraordinary period of global policy accommodation. The recent knee-jerk market reactions to any interpretation of a more hawkish Fed suggest that there may be a greater sensitivity to the hiking cycle in comparison to prior cycles. In order to capture this shift in sensitivity we allow a greater weight to recent history as opposed to equal weighting across time.

In order to capture the effect of a change in rate hike expectations we examine the reaction to Treasury yields rising by 50bp. We compare the effect of a rise in short-end versus long-end yields and find that equities appear to be more sensitive to changes in 10y yields. In particular, the scenario analysis suggests that US equities are likely to underperform other developed markets. EM assets – equities and FX – also suffer as Treasury yields rise. The dollar benefits from rising yields. The effect on commodities (not shown here) were also mixed as recent history has shown these assets becoming more sensitive to idiosyncratic supply and demand dynamics and are less correlated with broad risk on/off moves in other assets.

As for the effect of rising rates accompanied by rising growth expectations versus unchanged growth expectations, an interesting feature is that, over a long history, US equity returns generally improve if rate hikes are accompanied by rising growth expectations so that rather than a -6% sell-off, the response is closer to -2%. However, if we put a greater emphasis on recent history, US equities appear to have become less sensitive to changes in the growth outlook. The results with or without a growth upgrade are very similar for the S&P500, while other equity markets perform better as the growth outlook is revised higher. This suggests that in the next “rate shock” US equities may be more vulnerable to at least a temporary correction regardless of the economic backdrop.

Be the first to comment on "Testing the rate-hike scenario"