Luis Arroyo, in Madrid | Greece was in free fall mode when at the European Central Bank they had the funny idea of pushing the country …downwards. The ECB said it had frozen all operations with Greek banks, which already are suffering a killing capital drain:

“Central bank head George Provopoulos told Papoulias that Greeks have withdrawn as much as €700 million ($891 million) and the situation could worsen, according to the transcript of the president’s meeting with party leaders on May 14 that was published yesterday.”

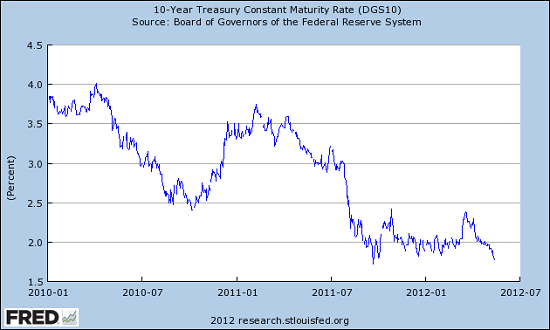

Even if it appears that the ECB move hasn’t been so definitive, the official word helped spike costs on 10-year credit for Spain beyond the 6 percent interest rate. The weak euro economies are now weaker, and the strong ones are stronger, with Germany paying less than 1.5 percent of interest rate on 10-year bonds. Even the US benefited: now the are paying less than ever before for their debt, as readers can see here.

And another bad bet is that on gold, that was supposed to help investors to hedge against inflation, deflation, every risk known. Well, there you go, gold diggers; going down, too.

Be the first to comment on "Thursday’s charts: dumb bets"