An Additional Tier 1 Capital Contingent Convertible (AT1 CoCo) is an hybrid issue that combines debt and capital properties. AT1 CoCos were created to help European banks raise assets to meet Basel III capital requirements following the 2008 financial crisis. According to Wisdom Tree, “under Basel III, some of the first AT1 CoCo bonds issued are now approaching their first call date (five years from issuance) and this year we will see for the first time how issuers will behave in terms of calling the AT1 CoCo bonds or extending them. Given this will set precedent for the market, investors are closely watching”.

One point of anticipation since 2018 was whether Banco Santander would call their 6.25% €1.5bn AT1 CoCo issue with the first call date on 12 March 2019. Typically, the closer you get to the call, the more scrutiny there is in the market as to whether an issuer will refinance the bond. As early as the Q3 2018, investors began to speculate on whether or not Santander would call the bonds and this was reflected in the cash price which fell to 94.48, nearly a 6% drop from par, on 4 Jan 2019. In early February, Santander issued new dollar-denominated AT1 CoCos, raising $1.2 billion, which sparked speculation from investors that the proceeds would be used to call the €1.5 billion bonds with an approaching first call. While this seemed plausible, under Basel III for bonds to be eligible as AT1 capital of the bank they must meet 15 specified criteria which also govern issuer behaviour. Experts at Wisdom Tree note that some aspects of the criteria include:

- A bank must not do anything which creates an expectation that the call will be exercised.

- Banks must not exercise a call unless they replace the called instrument with capital of the same or better quality and the replacement of this capital is done at conditions which are sustainable for the income capacity of the bank.

- The bank must demonstrate that its capital position is well above the minimum capital requirements after the call option is exercised.

Therefore, as market conditions are a fluid part of the equation it is important that investors understand the balance between calling the bonds at first call and maintaining the banks’ capital strength in doing so.

The AT1 CoCo market has experienced many firsts given that it’s a relatively new bond structure which emerged in 2013. While the wipe-out of Banco Popular’s AT1 CoCos in June 2017 was a significant event for this asset class, it should be expected other first times within the asset class to potentially grab investor interes such is the case with Santander and the level of interest it has gathered.

On 12 February 2019, Santander confirmed that they would not be calling the AT1 CoCos with a first call on 12 March 2019. This did appear to somewhat shock investors on the day, but bondholders have been burned by Santander in the past and should know that Santander is no stranger to controversy when it comes to liability management. While the bank’s euro-denominated AT1s cash price fell nearly 6% from par value last month, they bounced back to almost par on 11 February 2019 as investors began pricing in a higher likelihood that Santander would give notice on 12 February that they would call the bonds. In the end, funding costs to keep the AT1 CoCos outstanding was cheaper than current funding costs and Santander inferred that their decision would be purely based on market conditions.

This has surely rattled investors in the AT1 CoCo market for now as banks typically will call bonds at the first call option, but this has happened before in the subordinated debt space. For example, Deutsche Bank AG skipped a call option on its Euro Lower Tier 2 in 2008 and this also rattled markets at the time. Even as recent as 2016, Commerzbank AG and Standard Chartered Plc extended their subordinated debt.

Wisdom Tree believe that future behaviour will be driven by a combination of past issuer behaviour, the health of their balance sheet and market conditions.

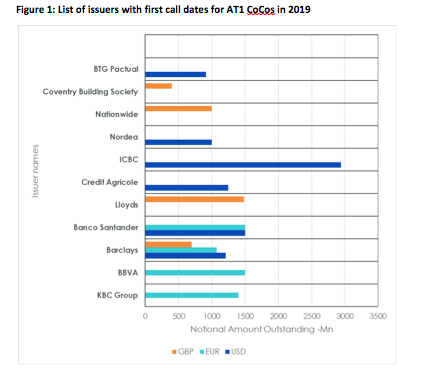

Therefore, we cannot infer that Banco Santander’s decision not to call the bonds will be a market norm going forward. There will be several large issuers of AT1 CoCo bonds that are approaching their first call in 2019 and should shed further light in terms of future market behaviour. For now, there is the possibility that this event will push yields higher in the AT1 market as the extension risk premia is repriced, especially for those bonds with low reset spreads. In the case of Santander, it could also be the case that investors require higher spreads for new issues. Figure 1 provides insight into issuers with first call dates approaching in 2019.

Source: Markit, Bloomberg. Data as of 31 December 2018

AT1 CoCos market is represented by the constituents of the iBoxx GBP Contingent Convertible Index, the iBoxx EUR Contingent Convertible Index and the iBoxx USD Contingent Convertible Index. The issuance is based on the first settlement date of the underlying CoCos in the referenced indices. The exchange rate applied to Euro and GBP issuance is the exchange rate as of the first settlement date as reported by Bloomberg. Historical performance is not an indication of future performance and any investments may go down in value.

You cannot invest directly in an index

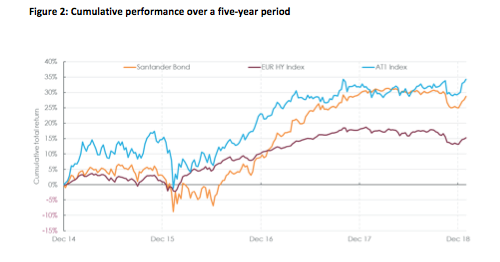

For investors within the AT1 CoCo market, instances where we see significant price action against individual bond issues highlights the benefit of being invested in a diversified index which has individual issuer caps at 7.5% as is the case with the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index (AT1 index). Below you can see that the AT1 index has outperformed both the Santander 6.25% AT1 CoCo with first call on 12 March 2019 and the Euro HY index on a 5-year basis. Annualized total return for the AT1 index was 7.58%, outperforming the Santander AT1 CoCo bonds and the Euro HY index by 102 basis points and 394 basis points, respectively over the period.

Source: Bloomberg, reflects cumulative performance from 31 Dec 2014 to 31 Jan 2019

Performance includes backtested data for the AT1 Index. Santander bond reflects the 6.25% Euro AT1 CoCo with first call 12 March 2019 (EK098732), Euro high yield index represented using the Bloomberg Barclays pan-European HY TR Euro Unhedged index (LP02TREU), and the AT1 index represented using (IBXXCCL1). You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion

Given that overall fixed income yields continue on the low trajectory relative to historical norms, investors are still on the hunt for higher yields within fixed income and few asset classes are able to provide a yield (yield to worst) of 6.95% as reflected by the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index as of 11 Feb 2019. Investors seeking to diversify across fixed income asset classes and who can become comfortable with the features embedded in AT1 CoCo bonds, can benefit from a yield pick-up relative to the more senior debt of the issuing bank.