Javier García Arenas and Adrià Morron Salmeron (CaixaBank )| Central bank independence is a more complex concept than it seems. In fact, it encompasses three spheres: i) the independence of its members, which is simply the limits imposed on politicians not to influence the composition of the central bank’s board of directors or its decisions; ii) financial independence, that is, central banks’ autonomy in order to manage their operations and not be captive to government decisions, and finally, iii) the independence of policies, or the central bank’s powers to elaborate and execute its monetary policy, for which, among others, it must not be forced to finance government spending and it must be able to set its own objectives or determine which instruments it uses (for example, the ECB sets the objectives for the euro area, while in the United Kingdom they are set by Parliament, but in both cases the central bank has autonomy in its use of instruments). Based on these three spheres, we can get an idea of whether a central bank is more or less independent.

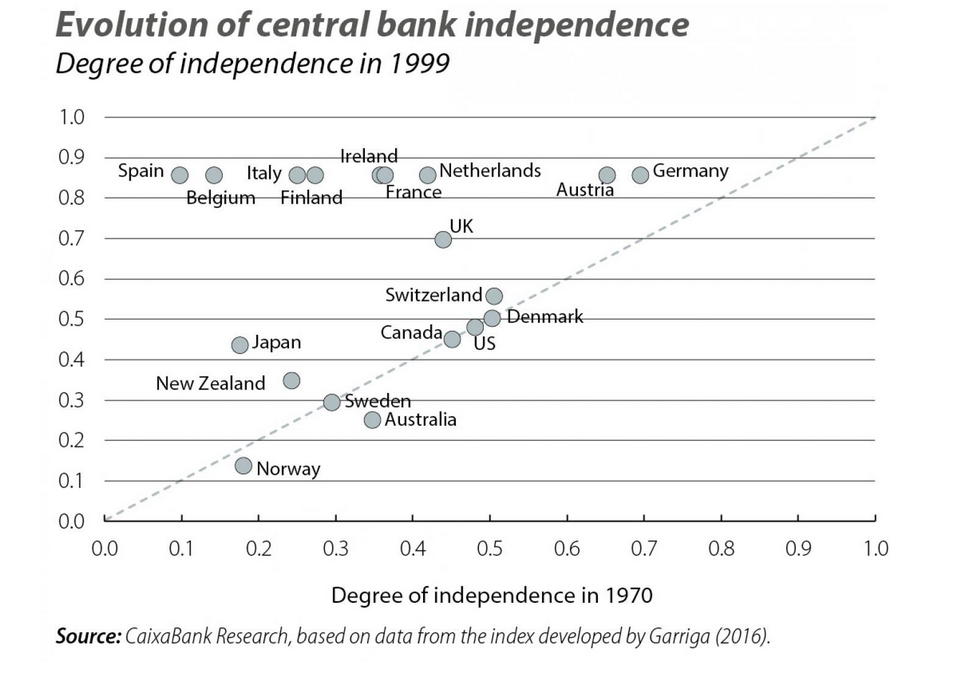

In order to approximate central banks’ degree of independence in quantitative terms, an aggregate index has been created which draws on the three spheres based on an analysis of the laws, decrees and constitutions that establish these institutions’ rules of operation around the world. The index increased significantly in advanced economies between 1970 and the late 1990s, by which time the independence regime had already been consolidated. Although after the Great Recession the index did not recede, more qualitative indicators do show a marked increase in political interference during the period 2010-2018, a trend which continues to cast its shadow in the context of strained public finances resulting from the COVID-19 crisis.

This process of strengthening independence arose out of concerns about high inflation between the late 1960s and the 1980s and consensus that an independent central bank with a well-defined objective – price stability – could reduce inflation without destabilising GDP. In the euro area, the creation of the ECB in 1998 in order to lead a common monetary policy made it possible to complete the convergence towards a model of independence like that of Germany (the Bundesbank was one of the few exceptions that already exhibited a high degree of independence in the post-war period, largely because the terrible recollection of the hyperinflation episode of the 1920s was still ingrained into the German people’s collective memory).

One of the main arguments in favour of central bank independence is to do with inconsistency over time: a central bank which focuses on the short-term and makes decisions tied to an electoral term, for instance, is incentivised to implement an expansive monetary policy to stimulate short-term growth, even if it results in a loss of credibility and an upward revision of medium- and long-term inflation expectations. For this reason, it is vital to lengthen central banks’ decision horizon and, in particular, to decouple them from the electoral horizons which largely dictate government decisions. If a central bank is to keep inflation expectations contained and stable, it must be credible, and that credibility is closely tied to its decision horizon. This is why central-bank members are often appointed for long mandates – eight years in the case of the ECB’s Executive Commission – which are not tied to the political cycle. Credibility is also achieved through the appointment of individuals who excel in their technical knowledge of monetary policy. It is also important that these individuals form an «epistemic community», that is, a group of people who talk the same language and have a similar world-view in order to strengthen the credibility and consistency of their decisions.

The practice: can the benefits of central bank independence be seen?

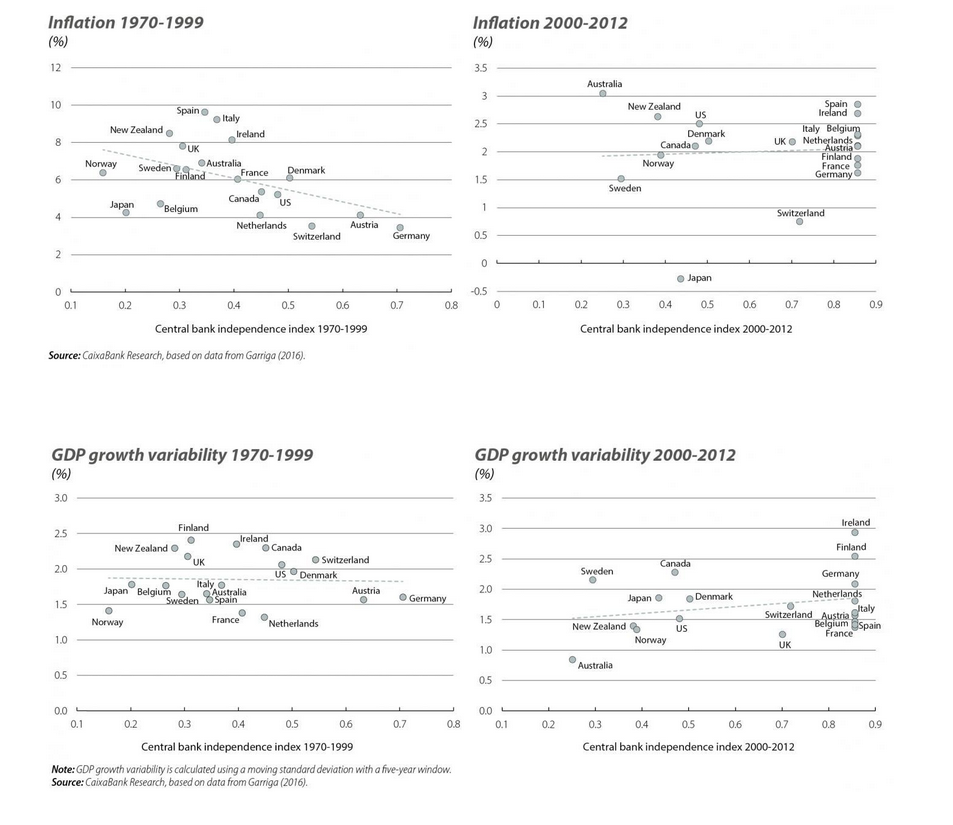

The theory is clear, but do the data support the benefits of this independence? Using the aforementioned central bank independence index, we explored whether strengthening the central bank’s independence actually allows inflation to be reduced without generating volatility in GDP growth. We performed this exercise for two very different periods: 1970-1999, the period in which central banks underwent the transition from somewhat lacking independence to being highly independent, and 2000-2012 (the latest available data for the index), when the new regime was fully consolidated.

The results show that, in the period 1970-1999, advanced economies with more independent central banks did a better job of containing inflation. The difference is stark: according to the statistical model – which is controlled using other important macroeconomic variables – if Italy (a country with a low degree of independence at 0.37 out of 1) had succeeded in increasing its central bank’s independence to Germany’s levels (the quintessence of independence in this period, with an index value of 0.71 out of 1), it would have been able to reduce its average level of inflation by more than 1.5 pps. These results empirically support the importance of preserving central bank independence. That said, caution must be taken in interpreting this relationship, as it does not take into account other parallel phenomena – such as globalisation or technological change – which also helped to curb inflation.

The third chart shows the absence of any statistical relationship between the variability of GDP growth and central bank independence. This is reassuring, as it suggests that central bank independence helped to contain inflation without increasing GDP volatility.

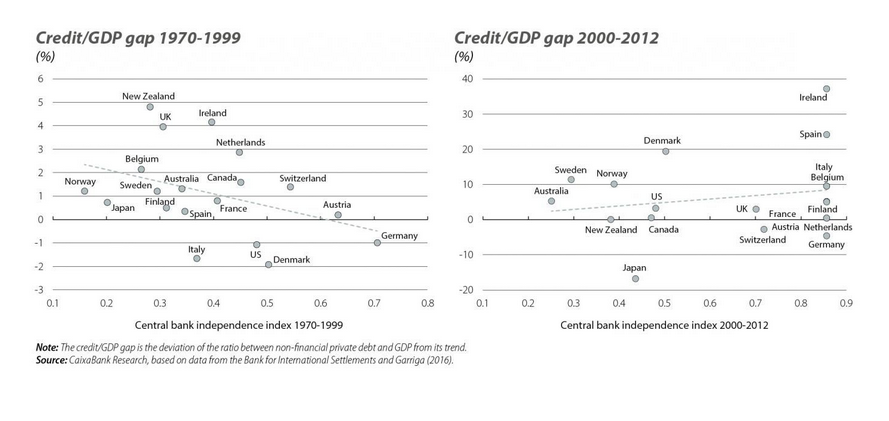

Finally, a less studied aspect is the impact that central bank independence can have on macro-financial variables. To shed some light on this aspect, we looked at the relationship between the credit gap – the deviation of non-financial private credit from its trend – and the independence index in the period 1970-1999. The results show a statistically significant relationship in the desired direction: greater central bank independence enabled positive credit gaps (i.e. excessive deviations in credit above their trend) to be reduced. Logically, the benefits of having an independent central bank can also be extrapolated to the bodies that regulate and supervise financial stability; a recent study shows that those economies which have increased the independence of these bodies over the past 20 years have reduced their non-performing loan ratios without diminishing the efficiency of their financial system.

In short, our small empirical incursion suggests that the benefits of central bank independence are more than just theoretical potential. In the current framework of the COVID-19 crisis, central banks have gained prominence in their role in providing essential support by keeping interest rates low and guaranteeing liquidity. In this particularly delicate context, it is imperative that monetary policy decision-makers preserve their independence and autonomy – something that is not at odds with accountability – in order to continue to make decisions with a long-term view, and that the necessary coordination between fiscal and monetary policy is the result of free and independent decisions.