Further out, divergent prospects for growth and monetary policy in the euro area and the US seem likely to underpin a persistent move lower in EUR/USD over the next 12 months. We remain short EUR/USD through a 3m put spread.

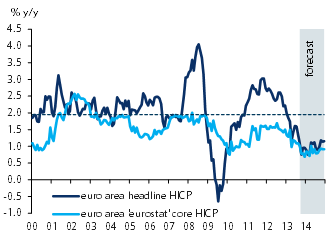

The lower-than-expected eurozone inflation number for October (0.7% y/y), together with the recent drop in liquidity surplus to well below €200bn, has focused the market’s attention on this week’s ECB meeting.

We expect the ECB to leave its interest rates and forward guidance unchanged at Thursday’s meeting, although the latest decline in inflation has raised the likelihood that the refi rate could be cut by 25bp in December (with a tightening of the policy corridor). We expect President Draghi to be queried on the deflation threats during the press conference. He is likely to argue that the internal devaluation is part of the necessary correction of imbalances, and that the recovery in economic activity is ongoing and the medium-term inflation expectations remain well anchored. Indeed, we noted that after the initial cheapening on the inflation data release, breakevens have edged slightly higher over the past few days, and that the 5y5y euro HICPx swap has moved back to 2.26%, slightly above its level before the string of preliminary inflation data surprises.

We also expect President Draghi to note the temporary nature of the downside surprise in the October inflation printing in the volatile prices. Indeed, we believe that the ECB would prefer to wait for November inflation data to get a clearer picture on price developments and to elaborate on its new inflation outlook, which will be presented at the December meeting with the quarterly update of its macro staff projections.

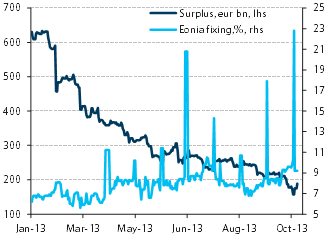

On the liquidity side, despite the surplus decline, there have been no “liquidity accidents” (with a consequent increase in Eonia rates) so far. The surplus has moved down €31bn since the October ECB meeting to €189bn currently, mainly because of banks’ repayment of their 3y LTRO borrowing (€29bn since the beginning of October), with the volatility of autonomous factors as the main determinant of a big swing in the surplus during the month (it dropped to about €155bn before moving back to about €190bn).

The Eonia fixing has moved up throughout October, although not significantly despite the tightening (and the higher volatility) in liquidity conditions. Indeed, the fixing has increased by a mere 0.9bp, to 8.9bp, with some volatility in the last week of October, probably reflecting some end-of-month effects.

We continue to believe that the ECB will remain vigilant on the evolution of liquidity conditions; however, it would likely require significant increases in Eonia fixing and in euro money market rates volatility before the ECB would take action. Also, we believe that the ECB would welcome further repayments of its 3y liquidity, even if it implies a decline in the surplus, because it would be a sign of reduced market fragmentation and of a reopening of banks’ funding market.

Among the all possible options for the ECB to use to counteract any liquidity issue, another LTRO (along with the roll of the full allotment) is the most likely (and powerful) tool, in our view, although the implementation/execution risk is not negligible.

Following the massive rally of euro short rates (and bull flattening of the money markets curves) after the release of the October inflation data, short rates have moderately sold off over the past few days, but they still price in some ECB’s actions. It is hard to estimate what the market is pricing for the upcoming meeting. However, given the current market expectations, the risk of some increase in volatility on euro short rates is not negligible, in case of no actions and no hints of near-term actions by the ECB.

Should this be the case, a return of the 1y1y Eonia forward toward the range of 40/50bp, approximately the trading level where it was before the Fed’s dovish comments at the September FOMC and before the shift of the ECB’s rhetoric on the possibility of another LTRO ( in mid-September), is likely. However, given the ECB accommodative stance any sell-off to 40-50bp of the 1y1y Eonia forward would be an opportunity to receive it.

We believe that the ECB will remain committed to its accommodative stance and vigilant to any significant change to the liquidity conditions or to the inflation outlook that could affect its stance. Any ECB’s actions should support the very front end, although with a risk of some volatility should the ECB disappoint the market’s expectations. The longer maturities should be less affected as global factors (such as expectations of the Fed’s tapering/hiking) prevail. This leads us to prefer at this stage a money market curves steepeners view in the form of widening of the golds versus green spreads or 1y 4y Eonia forward vs 1y 2y Eonia forward.

Be the first to comment on "ECB likely to respond to monetary tightening"