This week the European Central Bank published the latest edition of its “Eurozone Bank Lending Survey” with Q4’20 data showing the need for continued generous support from the central bank.

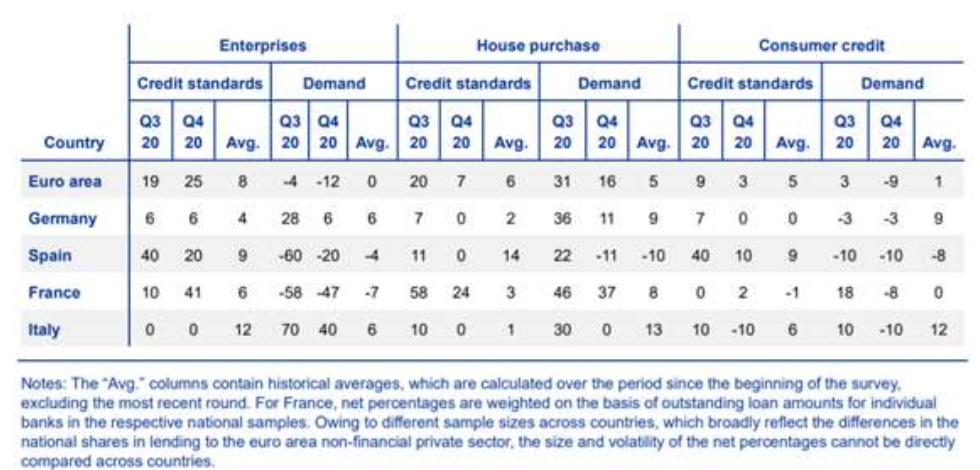

Despite the measures implemented by the ECB, the banks’ logical fear about the solvency of their debtors explains why the conditions for accessing bank credit are tightening. In Q4’20, credit conditions for households eased, but not in the case of companies, considering that both areas severely deteriorated in Q3’20.

In fact, bank credit conditions for companies tightened considerably in the EMU aggregate, even though Q3’20 data was already negative. However, the figures show large differences between countries which are not a coincidence. On the one hand, from a positive perspective, Italy is standing out with stable conditions in corporate lending. This was made possible by the fact that Giuseppe Conte’s government has articulated credit guarantees for an amount equivalent to one third of national GDP. By contrast, the worst situation was found in France, where conditions deteriorated sharply as a result of further restrictions to contain COVID- 19. These strangled demand from many companies already facing severe difficulties. So it is not surprising that French banks are concerned about the solvency of many firms and are demanding greater guarantees to grant them credit. Meanwhile, the situation in Spain is improving despite the tough environment. However, this does not prevent the aggregate conditions of corporate credit in the EMU from worsening and so the demand for it. In this respect, the downward effect resulting from the good performance of the primary corporate debt market should also be highlighted.