Scope Ratings | Over the past decade, a combination of tighter regulations, higher capital stacks, reduced risk and low- yielding business models have significantly reduced the returns available to bank equity investors. Rather than reducing their required cost of capital, equity markets have reacted with steep discounts on banks’ book values, raising questions about the long-term viability of the sector.

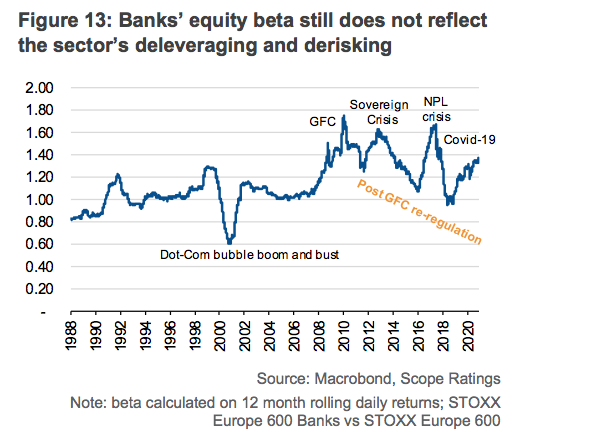

Judging by bank equity under-performance this year, the market is not convinced that the sector has successfully reduced risks. Despite their substantial de- risking over the past decade, European banks have remained high Beta stocks, under-performing the broader market on down days.

We believe such an ominous performance is due to the combination of several factors. Extending credit with a flat yield curve, slim risk margins and low leverage is a value-destroying business. Few banks can successfully cross-sell their banking clientele insurance and wealth management products.

With profitability permanently depressed by low interest rates and lack of profitable growth opportunities, many European bank CEOs embraced capital return as the strategy of choice to maximise shareholder value, raising expectations of generous dividend pay-outs and share buybacks. The supervisory blanket ban on bank dividends threw a spanner in the works, leaving the sector without an attractive equity story (no prospect of either growth or stable dividend yield).

The recent flurry of M&A activity shows just how cheap valuations had become for the sector. Trapped excess capital makes banks natural investors in other banks. Cost synergies add to the industrial logic, and we expect more deals to follow the deals already announced in Italy and Spain.

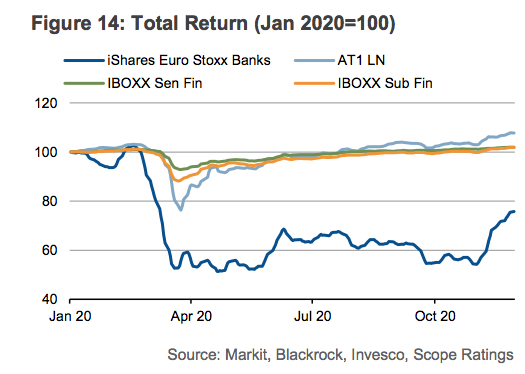

Looking at the sector from the perspective of a credit analyst leads to a much more positive assessment, as reflected in the pricing of AT1 securities in 2020 which once again materially outperformed bank equity. In addition, the consolidation of second and third-tier players into stronger competitors has further supported secondary market performance of smaller names.

Capital, liquidity and asset-quality metrics of many banks look better today than at the start of the year. Perhaps more importantly, the pandemic showed that in times of crisis, politicians, supervisors, and central banks are willing to extend significant help to the banking sector. No major European bank has come close to resolution this year; nor will any in the near future in our view.

Credit markets took note. After an initial scare in March, senior spreads tightened close to pre-crisis levels. Our view is that banking is indeed becoming more and more utility-like and that the sector is turning to be what it should be: boring.

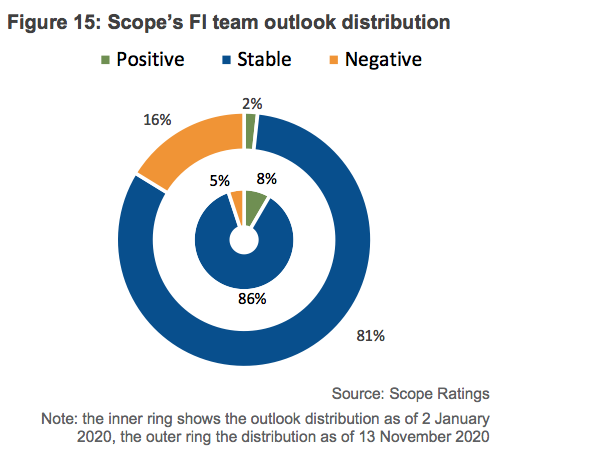

Across our coverage of about 75 banking groups in Europe, we have only had a handful of rating downgrades, and around 15 negative outlook changes, mostly related to banks with pre-existing financial health issues e.g. an unsustainably low level of pre-provision profitability, still-high levels of NPLs or high risk concentrations – including to domestic sovereign debt.