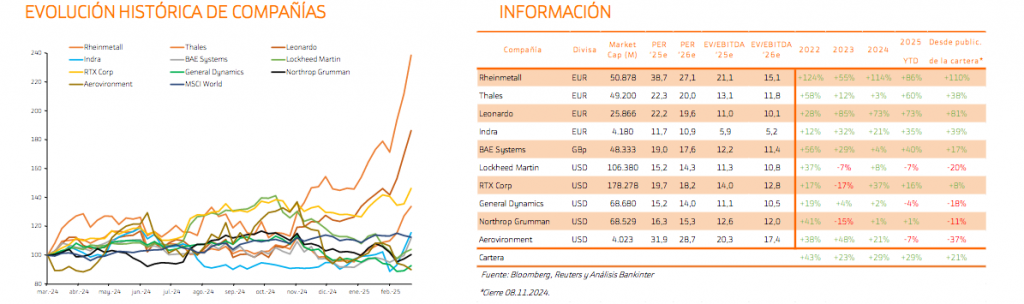

Bankinter: The good momentum in the sector continues and our thematic portfolio is up 30% for the year, especially thanks to European stocks. In February the Munich Security Conference ended without a preliminary agreement to put an end to the war between Russia and Ukraine, but with a clear conclusion: Europe must be prepared and significantly increase its defence spending. In line with this argument, some NATO countries have already spoken out. Among them, the UK Prime Minister (Keir Starmer) has stated that he will increase defence spending to 2.5 per cent of GDP by 2027 with the ‘ambition’ to raise it to 3 per cent by 2029. In this context, we continue to believe that the sector has good prospects for the coming years:

(i) Geostrategic environment: The defence sector is benefiting from the current armed conflicts (Russia and Ukraine, now approaching three years in duration, and Israel in the Middle East). In the first case, a peace agreement seems somewhat more likely, although the concessions that the US might make to Russia are unknown.

(ii) Trump’s election victory is generating increasing pressure from the US for European NATO member countries to increase their annual defence spending. In this regard, it is worth remembering that NATO requires member countries to dedicate at least 2% of their GDP to defence spending, while the Trump administration has already spoken out on two occasions about raising this threshold to 5%. Today, all EU countries are well below this figure. We believe that the change taking place in the sector is structural and that high growth rates are therefore likely to continue over the next few years. Furthermore, the sector is still trading at reasonable multiples if we take into account the significant growth expected in the future (average growth of BNA 24-26 of +15%).

Indra is the leading defence company in Spain and is partly owned by the Spanish government through SEPI. Almost half of the company’s EBIT comes from defence activity and the rest of its activity is focused on traffic, mobility and Minsait (technology). This year the company presented a strategic plan to 2030 in which it announced that it expects revenues at that date to exceed €10 billion and EBITDA margin to stand at 14% and EBIT at 12%. The company also announced that it will create an Aerospace division. The company is trading at the lowest multiples in the whole sector and has a TACC BNA 24-26 rate of 8%.