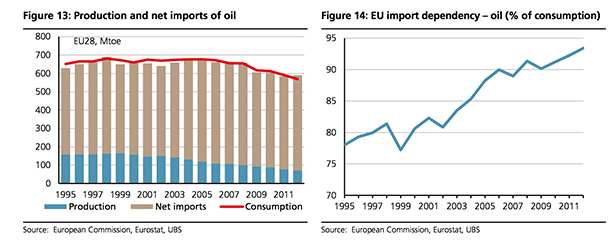

As UBS analysts comment in a long report released this week, import dependence is particularly high in oil, at 93% of consumption, but also in natural gas (66% of consumption). The import share in solid fuels (i.e. coal and lignite) is 42%, and 40% in nuclear fuels.

Numbers are on the rise and that adds to the fact that imports are not well diversified: 35% of oil is imported from Russia (which makes it normal for Brussels to worry about the Moscow-Kiev row since the continent remains exposed to the risk of energy supply disruptions); 33% from OPEC, 12% from Norway, 6% from Kazakhstan, and 5% from Azerbaijan (2011). Import diversification is even more limited in the case of natural gas, with 30% coming from Russia, 28% from Norway, 13% from Algeria, 11% from Qatar, and 4% from Nigeria.

But there is even a bigger problem for some EU countries: a number of them enjoy no or only slight diversification in their natural gas and oil supplies.

“The three Baltic states (Estonia, Latvia, and Lithuania) and Finland source their entire gas imports from one single supplier: Russia. Austria, Slovakia, the Czech Republic, Bulgaria and Hungary are also highly dependent on Russian deliveries. All these countries have a very high supplier concentration index for gas,” UBS reports.

PROVISIONAL SOLUTION

As a temporary solution, the European Commission has proposed that Gazprom and Naftogaz operate under a provisional agreement until the court ruling, expected next year. According to the interim agreement, Naftogaz will pay Gazprom US$3.1bn in Q4 14 (US$2.0bn in October) while Gazprom will supply 5bcm in Q4 14-Q1 15. This provisional agreement should reduce the risk of supply shocks in the coming 2014/15 winter. Nevertheless, UBS experts point out, a gas pricing agreement is needed to guarantee energy security in the long term.

Despite recent renewed concerns over instability in Ukraine, a new Brookings Institution policy brief concluded that Europe’s energy mix is not likely to change, which means Russia will remain a main supplier with a significant market share.

Be the first to comment on "Europe’s energy drama: import dependency is high –and rising"