Greece is on the brink of default. But Greece already is bankrupt, since it is losing its ability of generating income at a dizzying speed of -19 percent in five years. Yet, the Troika–the International Monetary Fund, the European Central Bank and the European Commission–keeps pushing the country further into morbid austerity as the only remedy.

There recently was a surprise, though, with the IMF showing signs of disagreement for the first time. The conflict is being played as if it were a discussion on the details of the financial programme, but I presume Ms Lagarde of the IMF has come to the conclusion that the current conditionality imposed on Greece will simply ruin it and drag it into internal conflict.

Economics professor at Oxford Simon Wren-Lewis has thoroughly examined the case, and his notes show how euro zone authorities have failed to manage the problem and their many, many mistakes.

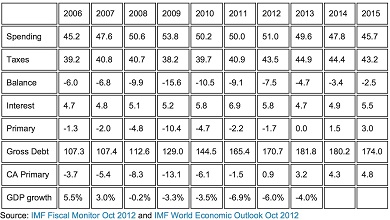

Because Greece has effectively obeyed, implementing the budget cuts requested by the Troika. As seen above, spending has contracted, but tax income has fallen even faster due to the recession. This year, Greece’s fiscal balance–excluding interest payments–has adjusted to -1.7 percent of GDP, but with interest payments at 5.8 percent of GDP, the total deficit is -7.5 percent. In the meanwhile, its debt per GDP grows and its GDP drops (-6 percent in 2012, forth consecutive annual fall).

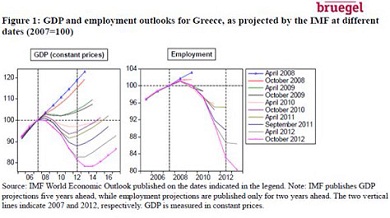

The biggest error has been to underestimate the real contraction effect of the administered budget cuts. As the chart below tells us, the IMF has had to review its GDP and employment forecasts, trapped between the stringent bailout measures. Accomplice of policies it was sceptic about, the IMF has played along forced by politics. Now, Ms Lagarde complains, as Spain’s president Mariano Rajoy should, too, instead of cowardly submit themselves to this euro torture.

Greece has one foot in hell, and other countries in the euro zone will follow its tracks, blindly moving ahead under the instructions of incompetent politicians. Spain, for instance, isn’t yet at that point, but there is little signal that its demise will be prevented. Unless Europe changes its plans, long-term unemployment and social unrest will become the only result of the economic pains we are just beginning to feel.

Be the first to comment on "Greece deserves better"