An increasing number of Europeans are becoming aware that the continent today is facing the biggest challenge to its social stability since World War II. This comes as a shocking wake-up call after six decades of economic integration which fostered peace on the continent, the last leap forward being the creation of the eurozone in 1999, when a number of EU countries began to share the same currency.

This venture, however, turned out to be a leap into the dark. While sharing real resources like coal and steel and also curtailing trade, social, and cultural barriers had effectively and nicely served the goal of cooperation, monetary integration proved to be an entirely different matter.

The design of the euro was based on bad economics, i.e., on the view that a) monetary policy is all that is needed to maintain a stable economy in the long run; and b) long-run growth is primarily driven by low production costs and low debt. This meant that Europe could live without a fiscal union. Indeed, this was seen as a way to force each country to limit its public deficit as a means of compelling its own government to downsize, cut entitlements, privatize, and discipline politicians to keep their own house in order.

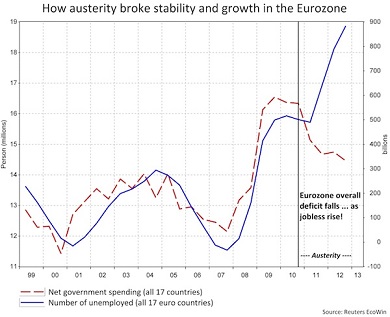

I will leave it to the reader to assess how effective the use of deficit constraints has been in accomplishing the goal of improving the quality and the integrity of European politics. In this column I would rather like to stress one too-often overlooked aspect of the economic collateral damage that results from such a politically questionable approach: Austerity may (although I doubt it) force politicians to behave, but it unquestionably generates economic and social instability.

Consider a well-known and unquestioned macroeconomic principle. Any federal sovereign budget (which Europe doesn’t have) ensures the efficacy of fiscal stabilisers, a device active in any fiscal union whereby taxes automatically decrease in the regions in recession, while maintaining welfare programs even in bad times. This device may not be sufficient to prevent a country-wide recession, but it softens the slump, prevents the further widening of regional differences, and may gradually restore jobs.

By choosing not to establish a centralised fiscal power, Europe has jeopardized economic stability, which was precisely one of the key proclaimed goals of the new Europe with a single currency: stability and growth. We have neither! While many analyses of the euro crisis begin with national divergences, it is interesting to move from the dimension of a single country to the eurozone level of analysis.

* Read the entire post via Social Europe Journal.

Be the first to comment on "How Austerity Broke European Stability"