Industrial production data in September were slightly weaker than we expected, adding further downside risks to our expectation that Italy’s GDP growth was flat in Q3. However, we think the early signs of stabilisation that emerged in H1 remain broadly on track as latest soft indicators (including PMIs) and trade data suggest.

That said, we continue to think that the government needs to accelerate the implementation of structural reforms and try to remove nominal rigidities and bottlenecks on the supply side of the Italian economy to boost growth potential. As political tensions between political parties belonging to the government coalition seem to have subsided as of late (reducing risks of snap elections in Q1 next year), we think that the government should take advantage of the relatively stable situation and reopen the reform agenda launched by the previous Monti government.

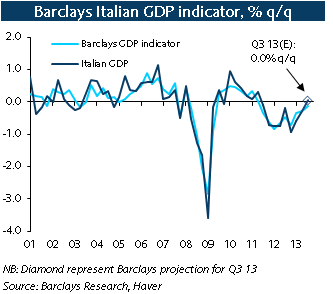

Downside risks to our Q3 GDP forecast have increased

Our GDP indicator now points to negative growth in Q3 (see chart below). Taking into account the latest IP data, in fact, GDP is likely to have declined 0.1% q/q in Q3 (-0.12% at 2DP), against our official forecast of a flat GDP reading (preliminary data for Q3 will be published on Thursday this week).

Detailed breakdown: Economic activity contraction subsides in Q3

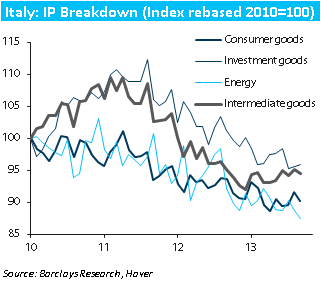

Industrial production edged up 0.2% m/m in September, in line with consensus and below our forecast (+0.5%). The August reading was revised upwardly to -0.2% m/m from -0.3% previously estimated by ISTAT. Overall, industrial output declined -0.9% q/q in Q3, the same as in Q2. Within the breakdown, tentative signs of stabilization in consumer and intermediate goods production remain, while investment goods output still lags together with energy goods production (chart below).

Be the first to comment on "Fragile recovery under way in Italy, but pace likely to remain slow"