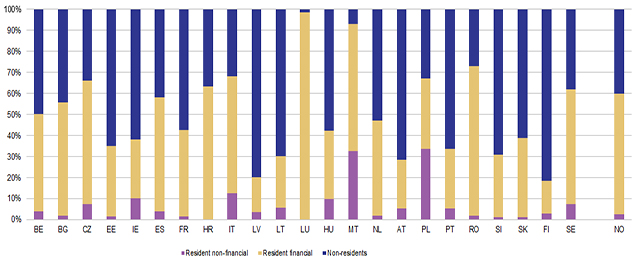

Eurostat released its biannual data about general government gross debt by sector of the debt holder on Thursday: non-financial residents (non-financial corporations, households and non-profit institutions serving households), financial residents (financial corporations) and non-residents (rest of the world).

The debt share of non-residents was significant for most of the countries but highly variable between countries: It ranged between 1.5 % and 81.6 % of the general government debt in the 24 EU and EFTA countries for which data is available. Twelve countries recorded percentages higher than 50 %: Finland (81.6 %), Latvia (80.0 %), Austria (71.6 %), Lithuania (69.9 %), Slovenia (69.2 %), Portugal (66.4 %), Estonia (64.9 %), Ireland (61.9 %), Slovakia (61.3 %), Hungary (57.7 %), France (57.3 %) and the Netherlands (52.8 %).

In contrast, this proportion was below 10 % in Luxembourg (1.5 %) and Malta (7.0 %). The resident financial sector accounted for between 60.5 % and 98.5 % in Luxembourg (98.5 %), Romania (71.3 %), Croatia (63.5 %) and Malta (60.5 %).

The resident non-financial sectors played a major role as debt holder in Poland (33.7 %) and Malta (32.5 %), followed by Italy (12.6 %), Ireland (10.0 %) and Hungary (9.7 %).

Be the first to comment on "No matter what, non-residents bet on French debt"