The unfolding story about the liquidity concerns at Espirito Santo International (ESI) and Rioforte are having implications well beyond the credit asset classes within Portugal, including a broader sell-off in other periphery markets. These two institutions have been funding themselves with large placements of commercial paper (CP) sold to both retail and institutional clients, which they are looking increasingly unlikely to be able to repay. With Portugal under a three-year troika programme until two months ago, investors are wondering why this was not detected and dealt with earlier. This event casts some doubt among investors about other latent problems in the system.

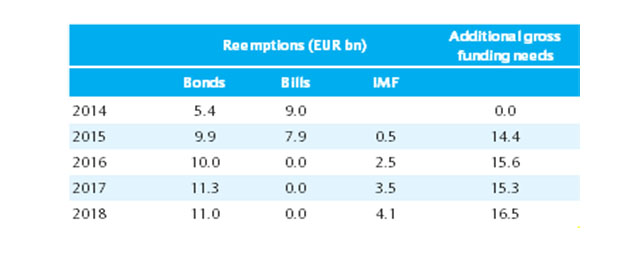

From the point of view of the banking system as a whole, notwithstanding any further bad news, the sovereign financial implications are rather limited. The sovereign has a relatively comfortable cash position and sufficient bank recapitalization funds. Specifically, the government estimates gross funding needs for 2014 of EUR13bn. Portugal has issued around €11.2bn in bonds YTD and a net -€2bn in T-bills, while receiving c. €5bn from official sources. PGB redemptions YTD have totalled €4.4bn which, if added to an estimated deficit YTD of around €3.5bn, results in an increase in cash of c. €6.3bn, taking the end 2013 Treasury cash position of €15.3bn to slightly over €20bn currently (of which €6.4bn was earmarked under the programme for bank recaps). This means that September’s €5.1bn PGB redemption can easily be met without resorting to further bond issuance over the summer, or in the rest of 2014. At the same time, economic activity in Portugal is to expand by nearly 1% this year. However, the very gradual recovery and the ongoing downward pressure on prices continue to make the public debt dynamics very challenging (at over 130% debt to GDP. On the political front, it is not expect any material disagreements within the government coalition until the 2015 elections, which will be presumably held in summer 2015.

It is perhaps the governance problems and reputational damage that are the main concern for Banco Espirito Santo (BES) and for Portugal more generally. The Espirito Santo situation is not a threat to the general banking system, with the Portuguese FM not seeing it as a threat to the financial stability of the public accounts. BES itself recently completed a €1bn rights issue, which bolstered its CRD IV fully phased in CET1 ratio to 10.5%. The government and Bank of Portugal have also acted decisively by removing BES management and nominating a new CEO and CFO – both reputed government technocrats.

The market reaction so far

EGB spreads have been under pressure in recent days. Portugal has led the way wider with underperformance in the 5-10y area of 41bp in the past week, and by over 80bp over the past month (by 45bp vs. Italy since 10 June). Spain and Italy have not been unaffected either with widening of 13bp and 20bp in 5y and 10y bonds vs Germany, respectively. Notably the underperformance has not been mirrored in the front ends of the periphery. BES equity and CDS have taken the brunt of the moves with BES shares halving over the last month from €1.11 to a current €0.51 with 25c of the move coming this week. In CDS terms, the week has seen BES 5y senior CDS move from 300bp to 450bp (and compared to 150bp in May). The worst moves of all, however, have come in EFSG senior 1-year debt with bonds moving from trading in excess of par in late June to around 30bp as at the time of writing.

Governance problems and complex inter-linkages are the key concerns

The situation is extremely complex due to a number of inter-linkages across the group of companies. ESI (Espirito Santo International) is the top holding company of the Espirito Santo family group of companies. ESI in turn owns 100% of Rioforte which is the holding company for the family’s non-financial operations (for example real estate). Rioforte owns 49% of Espirito Santo Financial Group (ESFG) which in turn owns 25% of BES.

Material irregularities in the financial statements of the holding company, ESI, have generated volatility across the group. This was identified following an audit and disclosed several months ago in BES’s Rights Issue Prospectus, and was picked up by the Wall Street Journal and since then the story has unfolded. The more immediate concern in the markets relates to liquidity. ESI and Rioforte have been funding themselves with large placements of CP to both retail and institutional clients, and there are widespread media reports, including one in the Wall Street Journal, 9 July, alleging that ESI has delayed repayment of Commercial Paper (note BES neither confirmed nor denied the reports).

What is Banco Espirito Santo’s exposure?

Due to complex cross holdings, the market has been attempting to decipher the risk to BES, which is now the bank within the BoP’s perimeter of consolidated supervision. Based on disclosure by the bank itself, BES is exposed to the frailties in the holding companies in the following ways:

a) BES sold €650m of the ESI/Rioforte CP to retail clients through its branch network and close to €1.95bn of CP to its institutional clients. BES has confirmed that it has not guaranteed any of this paper itself but it has referred to ‘reputational risks’ from the situation in its Rights Issue prospectus. The retail portion is at least partially guaranteed by ESFG.

b) BES has direct exposure to ESFG of close to €825m.

c) ESFG’s own exposure to ESI/Rioforte is around €2.35bn (including loans), based on disclosure by ESFG on 3 July. Concerns around ESI financial difficulties and the prospects of repaying the CP leave ESFG vulnerable to extensive losses on its exposures. This could have consequences for its 25% stake in BES, which it may have to sell.

The Portuguese banking System ahead of AQR

Portuguese banks are relatively well positioned for the Asset Quality Review component of the ECB’s comprehensive assessment. This is due to conservative non-performing loan classifications, a manageable amount of bad loans and adequate provisions, particularly considering there is evidence that credit quality in Portugal has reached an inflection point

For the stress test component of the assessment, Portuguese Banks were less well positioned due to modest capital buffers over the hurdle rates (8% in baseline and 5.5% in adverse). However a recent spell of rights issues by the largest banks has improved their preparedness for the stress test. BES recently completed a €1bn rights issue and BCP has also just announced a planned €2.25bn rights issue, the proceeds of which are intended to repay €1.85bn of the State Cocos. The fully loaded CET1 ratio for BCP proforma for the rights issue will be 9%.

Other periphery banks: should we be worried?

Much progress has been achieved to date in repairing the banking system under the umbrella of Troika programmes and with the support of public funds. There is increasing evidence that the credit cycle is turning up, especially in Ireland and Portugal. In Portugal, domestic credit quality showed signs of improvement with all the banks reporting lower NPL inflows and, as a result, lower NPL balances. Overall periphery bank debt spread performance has been strong (up until the recent events), largely reflecting improvements in fundamentals and market perception. Core capital ratios at peripheral banks are at the highest level they have ever been, exceeding 10% on average under Basel 3. Nonetheless, challenges for domestic peripheral banks remain, which may put the currently stretched valuations under strain.

Be the first to comment on "Sovereign implications of the Espirito Santo saga"