The start of 2013 does not seem to have brought about any significant change to the main factors that determined the development of the euro area’s economy last year. The processes of fiscal consolidation and private sector deleveraging, particularly intense in periphery countries, will keep domestic demand weak. The bulk of the evidence available suggests that the foreign sector will continue to be the main support for the euro area’s economy in 2013. Given this situation, the current surplus will continue to grow throughout 2013 although it might ease off as the year advances.

The data available up to October 2012 show great dynamism in exports of goods from the euro area, up 14.3% year-on-year. This figure exceeded the rise in imports over the same period, namely 6.9% year-on-year. Such a good performance by the balance of goods raised the cumulative current surplus over the twelve months prior to October to 79.44 billion euros, equivalent to 0.9% of the euro area’s gross domestic product (GDP). According to the forecasts of the European Commission, this trend continued over the last two months of the year, placing the current surplus at 1.1% of GDP, 0.8 percentage points above the figure for 2011.

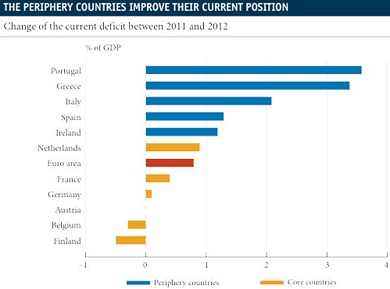

As can be seen in the graph above, the European Commission believes that this improvement in the current balance was almost widespread. Of the eleven main member states of the Monetary Union, only two recorded a decline in their current balance between 2011 and 2012. Of note is the considerable correction in periphery countries, reflecting the greater stagnation of their domestic demand. Greece and Portugal recorded the largest adjustments, in both cases above 3 percentage points of GDP.

A second inference from the graph above is related to the trend in the current balance of the different countries of the euro area. Specifically, improvements in the current balance were greatest in those countries with larger external imbalances. However, this was not merely due to a fall in surplus in the rest of the countries. For example, both the Netherlands and Germany, two countries that traditionally have considerable current surpluses, increased their positive balance further in 2012. This can partly be explained by the improved competitiveness of the euro area during 2012. A good example of this is the reduction in the nominal effective exchange rate of the euro.

For the new year, we expect a further increase in the euro area’s current surplus. However, the profile of the recovery for GDP in 2013, with greater economic activity in the second half of the year, suggests that this improvement in the current balance will ease off, a statement that is in line with the lower forecast for the increase in the euro area’s current balance for the whole of the year, namely 0.5 percentage points.

Be the first to comment on "The balance of goods continues to boost the euro current surplus"