J.LM. Campuzano (Spanish Banking Association) | Unstoppable digitalisation obliges the banks to adapt their structures to a multicanal approximation with the client. The client is in charge. And the banks have to proceed efficiently to satisfy their needs. So one of the objectives for the lenders at the moment is to find a balance between their physical branches and this new digital approximation which clients want.

Starting with their key asset: the employees. They are the ones who maintain the relationship with the client now, and will do so in the future. And they are the ones who know their clients best. Relationship and knowledge are the two key variables for the banks when they want to offer clients the best service. Taking this former conclusion as a starting point, it should come as no suprise that according to the latest survey published by Observatorio Inverco, over 70% of investors acknowledge that they prefer to sign a contract for an investment fund at bank branches. Just 13% will do this via the WEB.

The survey says a private investor puts a priority on yield and professional management. The latter is an important quality, within a context of investment dominated by so much uncertainty and where financial conditions are abnormally loose. And this exceptionality means investors perceive the risk of a monetary policy normalisation which is too quick and intense. And not just investors, but including the monetary authorities themselves.

Perhaps it’s precisely this combination of uncertainty and the risk of excesses which makes investors continue to consider a bank deposit as an interesting savings option. Over 48% of investors think that, again according to Inverco. In this way they can value the banks’ efforts to maintain positive returns on their deposits, in a world where over 30% of medium and long-term fixed income assets in the eurozone offer negative yields. And when the banks have to pay 0,4% on their deposits with the ECB.

One of Mifid2’s clear objectives is transparency. It is also focused on the protection of the investor. Are these two objectives incompatible with the fact that investors positively value how funds are currently sold? The reality of the numbers also shows the security and confidence with which savers value their bank.

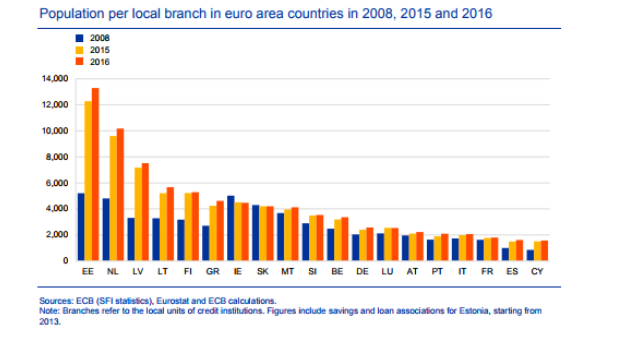

The Spanish banks’ branch network is much bigger than the European average in terms of population.

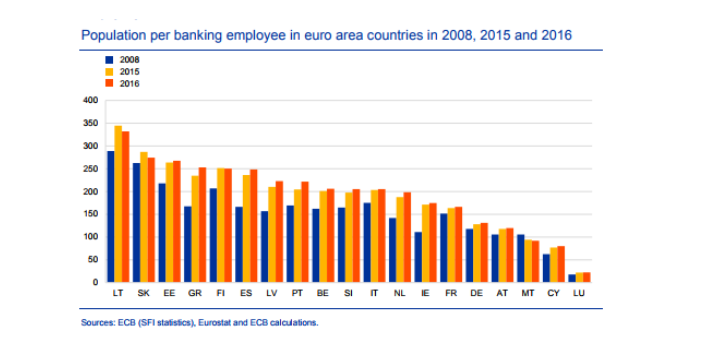

Of course our banks have a population ratio per employee above the European average, a true reflection of our greater efficiency.

And it’s precisely this efficiency, the best service for a reasonable price, which our banks should continue to pursue. Digitalisation is undoubtedly a challenge, but also an opportunity.