Allianz Global Investors has presented the Dividend Report 2021. According to the study, after falling to just under €290 billion in 2020, compared to €360 billion a year earlier, due to the Coronavirus crisis, dividend distribution is likely to rise again in 2021 to approximately €330 billion. Whatsmore, pre-crisis levels will not be reached before 2022.

The report also shows that, despite the health crisis-related downturn, dividends in Europe continue to contribute substantially to equity returns. Spain is the leading market for dividend yields in the Eurozone.

Although one-year payouts generally come from the previous year’s earnings, many companies cut or even suspended their dividends in 2020 as a precautionary measure. In some cases, companies were not allowed to distribute them because they had received state aid due to the crisis unleashed by the pandemic. Overall, just under three out of four European companies paid dividends last year, but more than 90 percent did so in previous years.

Jörg de Vries-Hippen, CIO European Equities at Allianz Global Investors commented, “As with the economic outlook, we do not expect a V-shaped recovery for the 2021 dividend payout.”

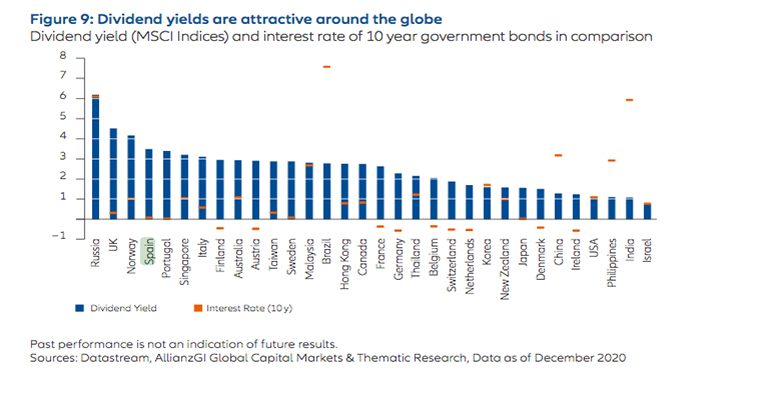

Dividend yields are quite attractive right now (as of December 2020). In Europe, they are considerably higher than corporate bond yields and, of course, government bond yields. In the US, dividend and corporate bond yields are similar, and both are higher than government bond yields. And in Asia Pacific, dividend yields are slightly above government bond yields. In many countries, dividend yields exceed 10-year government bond yields.