Miguel Navascués | Krugman reminds us of a very old expression, from at least four decades ago. Original sin is the emerging countries’ dependence on foreign financial capital. A vicious circle exists and the origin of it lies in the lack of confidence in these countries. That makes borrowing in local currency more difficult. As a result, investment needs are funded by foreign currency.

There are two ways of financing: direct investment, which does not present any problem, in fact the complete opposite: it reinforces confidence in the country on the receiving end. Then there is financial investment, which is more liquid and easier to recover. The lower the level of confidence, the greater this second type of financing.

That’s all fine and good, but to get hold of this in a competitive world, savers have to be guaranteed some basic things: namely, that the country risk is well managed, and that there will be no major loss of capital as a result of a sudden devaluation.

The country risk includes nationalisation, but also the possibility of a political change provoking a flight of capital (and not just international) which reduces the value of the capital, both domestic and foreign.

It’s also related to how solid the domestic financial markets are. Sooner or later these will be tapped, and that is where capital in local currency has to be liquidated in the end.

In other words, there are various elements all linked to confidence: the exchange rate, financial stability, domestic inflation…These elements make up the so-called “original sin”: certain situations cannot be allowed to continue in emerging countries for too long. In a word, they have less margin for internal expansionist policies than developed countries. This is what Krugman explains in the post referred to above.

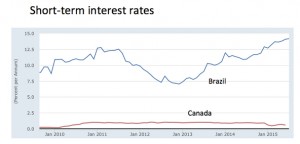

In the graph below, we can see what this difference means for two countries like Canada and Brazil.

They both export raw materials, both are entering recession and both, logically, are suffering devaluations. But Canada can allow itself the luxury of keeping its interest rates low because its low level of inflation gives its currency more room to depreciate, benefiting exports.

Brazil can’t do that. If its currency depreciates too much, it could face a capital flight and the country would find itself in a vicious circle of depreciation, capital flight, further depreciation, then inflation…From there, the difference in exchange rates between the two countries which can be seen on the graph.

So Brazil will probably experience a much harsher recession than Canada.

To sum up, there are no universal formulas in economic policy. There are countries which have a greater margin to implement counter-cyclical policies to moderate recessions or the unemployment rate. They can also allow and increase automatic fiscal stabilisers….And there are countries which can’t do that.

This is what causes the periodic interruption of “Catching Up” (catching up with the rich countries), at which Brazil is an old hand. As Marcus Nunes says, the eternal promise of prosperity which has been continually interrupted for decades.