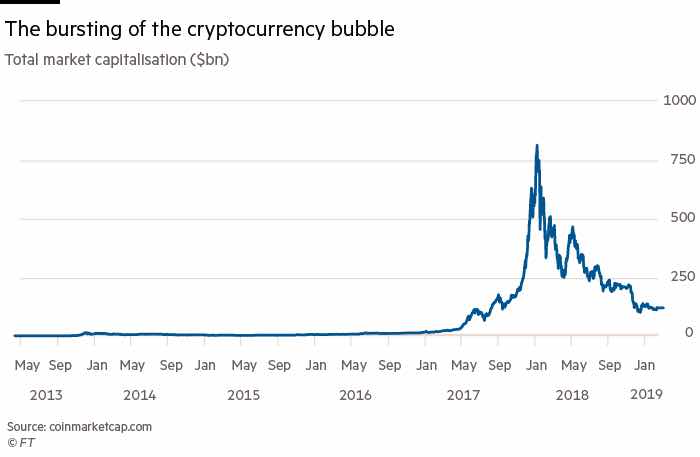

Cryptocurrencies, of which Bitcoin was the pioneer, and , according to the IMF, there are currently 1500 trading, have fallen just over 80% in dollar terms, some almost 99%, as we see in Martin Wolf´s graph.

Until now, they have only been a speculative bubble which burst, leaving bankrupt millions of people which had believed in the tale of anarcho-liberalism, which claims that they were the new international gold standard. But with 1500, or a million, possible candidates, it is difficult for states to take this data as a guarantee of stability.

Supporters of bitcoins say that it is precisely a case of them replacing the “oppressive state” in the creation of money, leaving every subject to use the money that he freely chooses, without a central bank which fixes supply and can debase the currency to take more than it should. What corresponds to the state is precisely the profits the Central Bank obtains, which is its property, and these profits derive from the differential or spread between the interest rates at which it issues or collects money.

The first thing which must be clarified is that the gold standard required the creation of a central bank to avoid the banking bankruptcies which happened before its creation, as Gordon shows in his book “Financial Crisis”, as well as a state which guaranteed the quantity of gold of determined carats which entered the corresponding account. With all currencies fixed to gold at a given rate they were all linked to each other. Therefore, the countries, of course a few rich countries, belonged to the gold standard club. Spain, for example, never belonged. But there was an unquestionable demand from society to participate in this gold standard. For two reasons: firstly the people wanted guarantees that they could pay their taxes with the official currency, and they also wanted a certain stability in relation to retail transactions, savings and investment, something which the bitcoin and the rest of the cryptocurrencies have not been able to provide.

All this is a way of saying that the criptocurrencies cannot be a legal currency while a) it is not supported by the state, which allows the payment of fiscal debt in that currency, and b) it cannot obtain a minimum stability, which, as we have seen, needs the intervention of the state. To deny these things is pure utopia. So it is an object of speculation which, certainly, has ruined may and enriched others, those who got out just in time.