Disciplined by an International Monetary Fund program, Iceland applied classic crisis measures such as write-down of debt and capital controls. But in times of shock economic measures are not enough: Special Prosecutor and a Special Investigative Committee helped to counteract widespread distrust. Perhaps most importantly, Iceland enjoys sound public institutions and entered the crisis with stellar public finances. Pure luck, i.e. low oil prices and a flow of spending-happy tourists, helped. Iceland is a small economy and all in all lessons for bigger countries may be limited except that even in a small economy recovery does not depend on a one-trick wonder.

“The medium-term prospects for the Icelandic economy remain enviable,” the International Monetary Fund, IMF, wrote in its 2007 Article IV Consultation

Concluding Statement, though pointing out there were however things to worry about: the banking system with its foreign operations looked ominous, having grown from one gross domestic product, GDP, in 2003 to ten fold the GDP by 2008. In early October 2008 the enviable medium-term prospect were clouded by an unenviable banking collapse.

All through 2008, as thunderclouds gathered on the horizon, the Central Bank of Iceland, CBI, and the coalition government of social democrats led by the Independence party (conservative) staunchly and with arrogance ignored foreign advice and warnings. Yet, when finally forced to act on October 6 2008, Icelandic authorities did so sensibly by passing an Emergency Act (Act no. 125/2008; see here an overview of legislation related to the restructuring of the banks and here more broadly on economic measures).

Iceland entered an IMF program in November 2008, aimed at restoring confidence and stabilising the economy, in addition to a loan of $2.1bn. In total, assistance from the IMF and several countries amounted to ca. $10bn, roughly the GDP of Iceland that year.

In spite of mostly sensible measures political turmoil and demonstrations forced the “collapse government” from power: it was replaced on February 1 2009 by a left coalition of the Left Green party, led by the social democrats, which won the elections in spring that year. In spite of relentless criticism at the time, both governments progressed in dragging Iceland out of the banking mess.

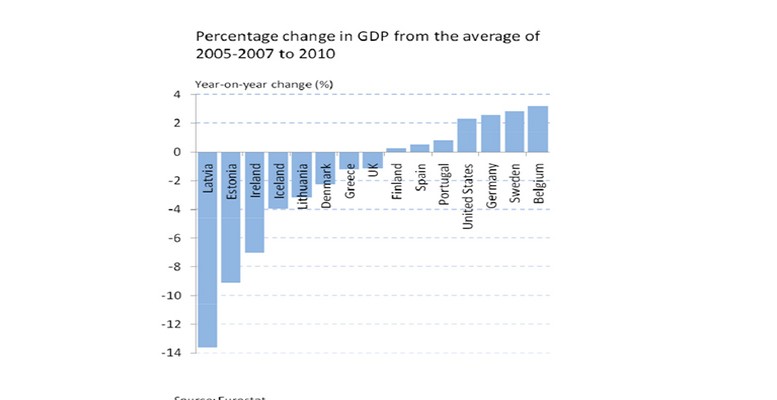

After the GDP contracted by 4% in the first three years the Icelandic economy was already back to growth summer 2011 and is now in its fifth year of economic growth. In 2015, Iceland became the first European country, hit by crisis in 2008-2010, to surpass its pre-crisis peak of economic output.

Iceland entered an IMF program in November 2008, aimed at restoring confidence and stabilising the economy, in addition to a loan of $2.1bn. In total, assistance from the IMF and several countries amounted to ca. $10bn, roughly the GDP of Iceland that year.

In spite of mostly sensible measures political turmoil and demonstrations forced the “collapse government” from power: it was replaced on February 1 2009 by a left coalition of the Left Green party, led by the social democrats, which won the elections in spring that year. In spite of relentless criticism at the time, both governments progressed in dragging Iceland out of the banking mess.

After the GDP contracted by 4% in the first three years the Icelandic economy was already back to growth summer 2011 and is now in its fifth year of economic growth. In 2015, Iceland became the first European country, hit by crisis in 2008-2010, to surpass its pre-crisis peak of economic output.

Iceland is now doing well in economic terms and yet the soul is lagging behind. Trust in the established political parties has collapsed: instead, the Pirate party, which has never been in government, enjoys over 30% following in opinion polls.

Compared to Ireland and Greece, Iceland’s recovery has been speedy, giving rise to questions as to why so quick and could this apparent Icelandic success story be applied elsewhere. Interestingly, much of the focus of that debate is very narrow and in reality not aimed at clarifying the Icelandic recovery but at proving or disproving aspects of austerity, the euro or both.

Unfortunately, much of this debate is misleading because it is based on three persistent myths of the Icelandic recovery: that Iceland avoided austerity, did not save its banks and that the country defaulted. All three statements are wrong: Iceland has not avoided austerity, it did save some banks though not the three largest ones and did not default.

Indeed, the high cost of the Icelandic collapse is often ignored, amounting to 20-25% of GDP. Yet, not as high as feared to begin with: the IMF estimated it could be as much as 40%. The net fiscal cost of supporting and restructuring the banks is, according to the IMF 19.2% of GDP.