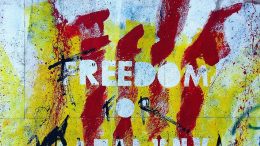

The Catalan Crisis Is Intensifying And Spaniards’ Confidence Is Declining

We have reached the next stage in the Catalan crisis. Rajoy’s government – with the agreement of Pedro Sánchez and the Cs – has requested that Catalan president Puigdemont clarifies whether or not there has been a declaration of independence. Otherwise, article 155 of the Constitution will be implemented, implying a limitation on the region’s autonomy. Against this backdrop, Spaniards’ confidence is being eroded.