ECB: We need a QE shot (not 17 of them, JPMorgan)

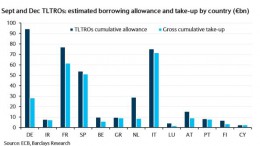

MADRID | The Corner | It’s speculation day before the European Central Bank’s tomorrow meeting. Will a QE plan finally be announced? Experts at Santander bank think that, if announced too early, it could damage TLTROs. JP Morgan economists believe there is a 30% chance we’ll get a QE shot in 2014, 50% next year. And they’ve come with a proposal we find erratic: 17 different bond buying plans, one for each state member. That is exactly the opposite direction the EU needs to be heading to.