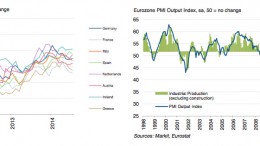

EZ manufacturing sector expands in July, but France continues deteriorating

BERLIN | By Alberto Lozano | Despite of the growing concerns following the escalation of the crisis in Ukraine towards the end of the month, the EZ manufacturing PMI index remains expanding in July (51.8), according to Markit data published today. Netherlands (53.5), Germany (52.4) and Austria (50.9) saw an acceleration of the growth, while Greece (48.7) continues depressed and France (47.8) keeps being the “Europe’s sick man” and the main brake to the European growth. With the worst figure in Europe, the French manufacturing sector even contracted in July at the fastest rate since December. Meanwhile Ireland (55.4), followed by Spain (53.9), registered again the sharpest rate of growth, supporting the eurozone manufacturing recovery.