The total volume of TLTROs will amount to around Eu400bn based on the 7% figure, and range from as little as Eu8bn in Ireland and Finland to as much as Eu95bn in Germany, Eu77bn in France, and Eu75bn in Spain.

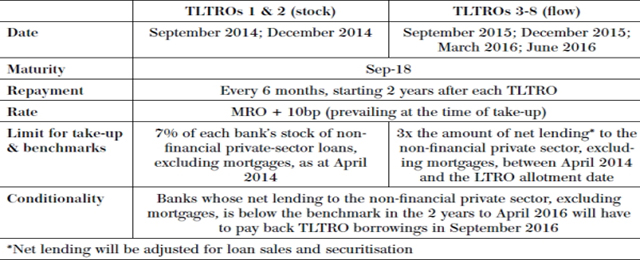

If banks’ net lending to these clients after April 2014 exceeds a benchmark set by the ECB they will be able to borrow up to three times the cumulative net lending above their bank-specific benchmark in six further TLTROs that will be conducted quarterly from March 2015 and June 2016.

“These are not tiny measures we are adopting,” Mr Praet said during a conference of bankers in Paris. However, the effects on the real economy will take some time as always, he pointed out.

Be the first to comment on "ECB’s Praet: TLTRO will break the lack of credit’s vicious circle"